Business Line of Credit Calculator - Determine Your Affordability

If your business requires funds for working capital, unexpected expenses, or fluctuating project costs, a business line of credit can offer the financial support you need to stay on course.

Utilize this small business line of credit calculator to discover how manageable a credit line can be for your company.

Understanding a Business Line of Credit

A business line of credit offers approved businesses flexible access to funds whenever they need them. With this financial tool, you can withdraw the necessary amount for your business requirements and pay interest solely on the utilized portion of the credit. There is no obligation to use the entire credit line, allowing you to manage your borrowing efficiently based on your specific needs. This flexibility makes a business line of credit an ideal solution for handling unexpected expenses, managing cash flow, and financing various projects.

Understanding Your Repayment Structure with a Business Revolving Line of Credit Calculator

Before securing a business line of credit, it’s crucial to use a small business line of credit payment calculator to gain a clear understanding of your anticipated payments.

Take into account the following cost factors before making your decision:

Loan Terms Explained

With a term loan, the entire loan amount is disbursed upfront, and you adhere to a fixed repayment schedule over a predetermined period.

In comparison, a business line of credit operates differently. You only make payments after you withdraw funds, and once you do, the repayment terms are established, similar to a term loan.

The length of repayment periods can differ significantly based on the lender. Typically, these periods range from 12 months to 10 years, with a common duration being around 24 months. However, the exact terms will be influenced by your business’s qualifications and the lending institution’s policies. By understanding these variations, you can choose the financial product that best suits your business’s needs and capabilities.

Interest Rates

Interest on a business line of credit is only charged on the amount you actually withdraw, not on the total available credit limit. This makes using a business line of credit loan calculator a valuable tool for estimating your potential costs.

Your interest rate will depend not only on your business’s qualifications but also on the source of your line of credit. Traditionally, banks offer the lowest interest rates, while alternative lenders often charge higher rates due to the greater risk they take on.

However, it’s crucial to consider the overall cost. Although bank rates may seem lower at first glance, the total interest paid might be less with an alternative lender because they typically offer shorter repayment terms, ranging from 12 to 24 months, compared to conventional lenders. Understanding these nuances can help you make an informed decision that best fits your financial situation.

Fees Not Included in a Business Line of Credit Interest Rate Calculator

When evaluating a business line of credit, it’s important to recognize that certain fees are not typically included in the interest rate calculations. The most common fees associated with a business line of credit are application fees, origination fees, and draw fees.

- Application and Origination Fees: These are one-time costs incurred when setting up your credit line.

- Draw Fees: These fees are charged whenever you withdraw funds from your credit line. They often range from 1% to 3% of the amount borrowed.

- Maintenance Fees: Some lenders may charge a small monthly fee for non-use of the credit line, which could be around $20.

- Late Payment Fees: If you miss or delay payments, you may incur additional charges.

Because these fees are not included in the interest rates, it is essential to consider them when calculating your total borrowing costs. By incorporating these estimated fees into your financial planning, you can gain a more comprehensive understanding of the true cost of a business line of credit for your company.

Business Line of Credit Calculator: Estimating Your Monthly Payment

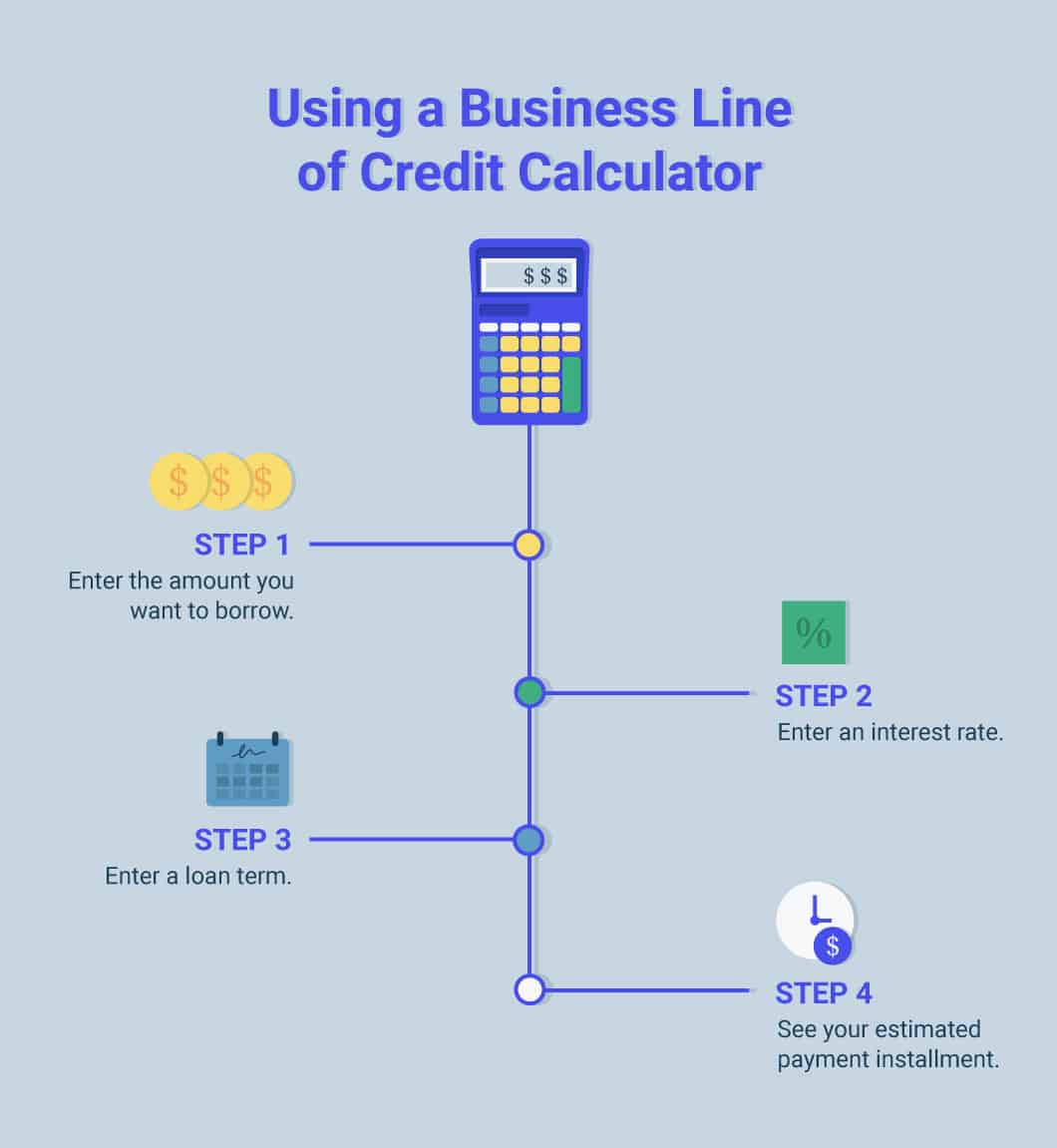

A business line of credit calculator helps you estimate your monthly payment if you were to fully utilize your available credit line.

Key Factors Considered by the Calculator:

- Loan Amount: This is the total credit limit available to your business.

- Interest Rate: The rate at which interest is charged on the amount you withdraw from the credit line.

- Loan Terms: The duration over which you will repay the borrowed funds, typically ranging from 12 months to 10 years.

By entering these details into the calculator, you can get an estimate of your monthly payment obligations if you decide to draw the entire credit line. This tool provides valuable insight into how borrowing could impact your business’s cash flow and financial planning.

Example Using the Business Line of Credit Calculator

Let’s explore a sample scenario to see how a business line of credit calculator works:

Imagine you have been approved for a $50,000 line of credit with an 8% interest rate and a repayment term of 24 months.

If you decide to draw the entire $50,000 at once, the business line of credit calculator would estimate your monthly payment to be $2,261. You would make this payment every month for two years.

With a revolving credit line, as you repay your debt, you regain access to the available credit, allowing you to borrow again as needed, although this might include a draw fee.

This example highlights how the calculator uses the loan amount, interest rate, and loan term to estimate your monthly payment obligation if you fully utilize the line of credit. This helps you understand the financial commitment involved and plan your business finances accordingly.

Understanding Your Business Line of Credit Calculator Results

By using iBusinessLender’s business line of credit loan calculator, you can get a clear picture of your potential monthly payment obligations.

Simply use the calculator provided at the top of this page. By inputting various credit line amounts, you can see how different borrowing scenarios affect your overall costs.

This interactive tool offers valuable insights, helping you make an informed decision about the best line of credit to suit your business’s financial needs.

The Final Calculation on Small Business Line of Credit Calculators

When exploring the best business line of credit options, using a payment calculator can help you estimate your costs effectively. If you have received multiple offers, it’s important to compare the interest rates, repayment terms, and fees associated with each one.

If you’re just starting your search, business line of credit payment calculators are invaluable tools. They allow you to assess your potential costs and help determine the appropriate credit line amount and repayment capacity for your business based on the calculated estimates.

Whether you are actively seeking a line of credit or simply curious about what a revolving business line of credit calculator can reveal, iBusinessLender offers the resources and information you need. If you have further questions about your line of credit payment calculator results, our team of expert Business Advisors is ready to guide you through the process and help you make informed financial decisions for your business.