Securing a business loan or other types of financing, along with obtaining favorable rates, can be more straightforward than many anticipate. The process starts with gaining a clear understanding of the financing options that are most suitable for your small business.

5 Steps to Obtaining a Business Loan

Conducting comprehensive research and due diligence before applying for a small business loan is crucial. This preparation helps you pinpoint the most appropriate financing options tailored to your current needs and future repayment capabilities.

If you’re unsure how to apply for a small business loan, follow these five essential steps:

- Clarify Your Purpose for the Loan: Understand and articulate why you need the loan, whether it’s for expanding your business, managing cash flow, purchasing equipment, or other specific needs.

- Evaluate Your Financing Eligibility: Review your financial health, credit score, and business performance to assess your eligibility for different financing options. Knowing where you stand will guide you towards lenders that match your profile.

- Choose the Right Type of Financing: Explore various types of business financing, such as traditional bank loans, lines of credit, SBA loans, or alternative financing solutions. Select the one that best fits your business requirements and repayment capabilities.

- Prepare All Required Documentation: Gather all necessary documents and information, including financial statements, tax returns, business plans, and any other paperwork required by potential lenders. Having these ready will streamline the application process.

- Submit Your Application: Complete and submit your loan or financing application to your chosen lender. Ensure all information is accurate and complete to avoid delays in the approval process.

Step 1: Why Do You Need a Business Loan?

Why do you need external funding? Are you looking for a loan to launch your small business, manage daily expenses, or secure capital for growth and expansion?

According to the Federal Reserve Banks’ State of Small Business Credit Survey, small businesses applied for funding in 2020 for several key reasons:

- Meeting Operating Expenses: 58%

- Expanding the Business, Pursuing New Opportunities, or Acquiring New Assets: 38%

- Refinancing or Paying Down Debt: 32%

- Making Repairs or Replacing Capital Assets: 22%

Clearly defining your reason for seeking a business loan will help you identify the most suitable financing options and streamline the application process. Here are some funding options tailored to various business needs:

- Partner with individual investors or investment groups to raise startup capital.

- Manage cash flow gaps caused by waiting for customer payments or seasonal slowdowns.

- Cover operating costs during low-revenue periods.

- Handle emergency repairs quickly and efficiently.

- Purchase essential equipment to maintain or boost productivity.

- Take advantage of limited-time offers, such as discounted inventory.

- Expand your product or service offerings to attract new customers.

- Acquire another business to increase market share.

- Open a new retail location, warehouse, or office space to grow your physical presence.

How Much Funding Do You Need?

Many business owners considering applying for funding often ask, “How much financing can I get?” A more important question is, “How much do I need to borrow?”

Having only a rough estimate of your financial needs can lead to borrowing more than necessary, resulting in higher interest payments. Conversely, being too conservative in your loan request can leave your business underfunded, threatening its financial health and growth potential.

To avoid these pitfalls, it’s crucial to accurately assess your business’s financial needs. Start by identifying the specific purposes for the loan, such as covering short-term expenses, funding a project, or expanding your operations. Next, conduct a detailed review of your business’s financials to determine a realistic borrowing amount that will meet your needs without straining your repayment capacity.

Additionally, analyze your cash flow and profit margins to understand how much you can comfortably allocate towards loan repayments. This will help ensure that you can manage the debt without compromising your business’s day-to-day operations.

Step 2: Know Whether You Qualify for Financing

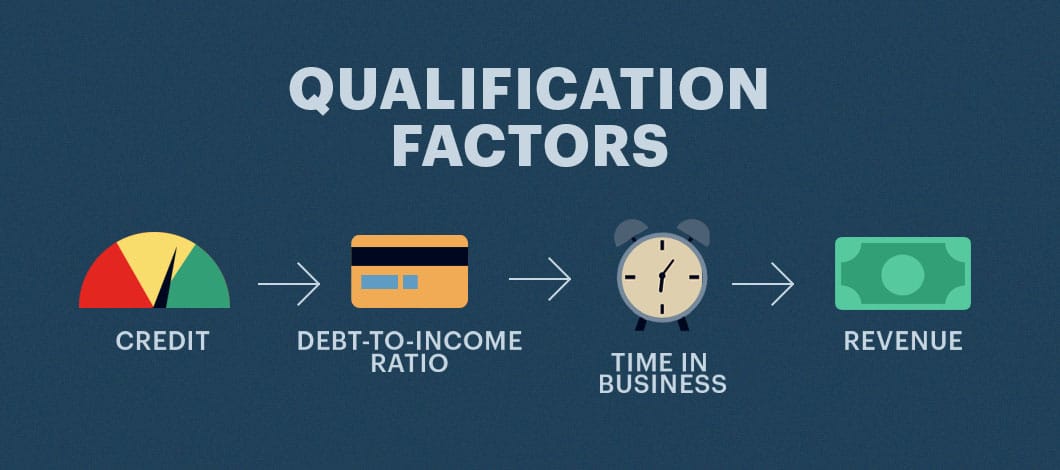

Not all small businesses are viewed equally by lenders. Lenders use specific metrics and scores to distinguish highly qualified businesses from those deemed riskier. To secure an affordable business loan, it’s essential to position your business within the more favorable category.

Credit Score and History

Your business credit score, akin to a personal credit score, mirrors your business’s financial health and debt management practices. Different credit-reporting agencies have varying scales: Dun & Bradstreet (D&B), Experian, and Equifax utilize a 0-100 scale, while FICO operates on a 300-850 scale. Typically, achieving a score of 80 or 90 out of 100 places your business in the “low risk” category. According to Experian, a FICO score between 670-739 is considered good, while 580-669 is fair.

Building a robust credit rating takes time, so many lenders also take personal credit scores into account.

The required credit score for a small business loan varies by lender and financing type. Traditional lenders, like banks and credit unions, generally require a minimum score of 670. In contrast, alternative lenders might accept lower scores.

Besides your credit score, lenders will examine your credit history, focusing on your debt repayment timeliness, the amount of financing previously received, and your current debt obligations.

Debt-to-Income Ratio

Lenders assess your debt-to-income (DTI) ratio to gauge your business’s financial health and its capacity to handle additional debt. A preferred DTI ratio is below 35%, although ratios up to 50% might be acceptable in certain industries. A high DTI ratio could make you a less attractive candidate for a business loan.

Time in Business

The duration your business has been operating affects loan eligibility. Online and alternative lenders usually require at least one year of operation, whereas banks and credit unions typically prefer businesses with 2-3 years of history.

Revenue

Your business’s revenue is a crucial factor in loan approval. Requirements differ by lender and financing type. Some lenders might approve businesses with less than $100,000 in annual revenue, while others may set the minimum at $250,000.

Understanding these factors can help you better prepare for securing a business loan and ensure you meet the necessary criteria for approval.

Step 3: Choose a Form of Business Financing

A long-term bank loan isn’t your only financing option. Here are 4 of the most popular financing alternatives for small businesses:

SBA Loans

Many financial institutions are often hesitant to extend loans to small businesses, viewing them as high-risk due to factors such as low revenue, short operational history, or poor credit scores. However, loans backed by the Small Business Administration (SBA) help reduce this risk for lenders.

These SBA-backed loans, characterized by their low-interest rates, are provided by commercial banks, financial companies, and nonprofit lenders. The SBA’s guarantee on a portion of these loans minimizes the lenders’ exposure to risk. Additionally, the SBA sets caps on interest rates and loan fees, making these loans one of the most affordable financing options for small businesses.

Obtaining a long-term SBA loan can be competitive, so it is essential to be well-prepared and meet all the required criteria.

-

Do you qualify?*

- In business 2 or more years

- Annual revenue of $50,000 or higher

- Credit score of 650 or better

*iBusinessLender requirements for borrowers

Business Line of Credit

Business lines of credit offer a flexible and convenient financing option, allowing you to draw funds as needed and supplementing a conventional loan if required.

Advantages of business lines of credit include:

- Flexible cash-flow management

- Lower interest rates and higher limits compared to many credit cards

-

Do you qualify?*

- In business 1 year or more

- Annual revenue of $200,000 or more

- Credit score of 560 or higher

*iBusinessLender requirements for borrowers

Equipment Financing

If your business operates in an industry that relies heavily on equipment, such as healthcare or construction, you may be eligible for equipment financing. This type of loan allows banks and other lenders to provide funding that can cover up to 100% of the equipment’s value. You then repay this loan over time with added interest.

A significant advantage of equipment financing is the typically lower interest rates. Since the equipment being purchased serves as collateral for the loan, lenders face reduced risk. This collateralization keeps interest rates affordable, even if you don’t have other assets to offer as additional security. Additionally, this type of financing can help businesses maintain cash flow and preserve working capital, as it spreads out the cost of expensive equipment over a manageable period.

-

Do you qualify?*

- In business 2 years or more

- Annual revenue of $160,000 or more

- Credit score of 620 or higher

*iBusinessLender requirements for borrowers

Picking the Right Lender

Many new entrepreneurs often believe that securing a small business loan requires approaching a large national bank. However, your chances of approval might actually be higher if you seek financing from a smaller, regional bank.

As you explore options for obtaining a small business loan, it is beneficial to consider a variety of lenders. These include not only regional banks but also credit unions, which often have more flexible lending criteria. Nonprofit financiers are another excellent option, especially for businesses with a social mission or those located in underserved communities. Additionally, alternative lenders, such as online marketplace operators like iBusinessLender, can provide more accessible and faster loan processing, catering to a wide range of business needs. By diversifying your search and considering these different sources, you can increase your chances of finding a loan that best suits your business requirements.

Review your funding options and research where to get a small business loan from various sources, including:

- Big banks (e.g., Wells Fargo, JPMorgan Chase)

- Regional banks (small local chains)

- Nonprofit lenders

- Alternative lenders and online lending marketplaces (e.g., iBusinessLender)

- Microlenders

- Credit unions

Loan approval rates have improved in 2021 as the economy recovers from the pandemic downturn. As of July 2021, approval rates were as follows:

- Big banks: 13.8%

- Small business banks: 19.1%

- Institutional banks: 23.9%

- Alternative lenders: 24.7%

Step 4: Gather Your Documents and Other Relevant Information

Make sure your company’s financial records are organized and accessible before applying for a business loan or other form of financing.

Required documents include the following:

- Government identification

- Business license and permits

You also will need to provide proof that you’re the lawful owner of your company, such as the following:

- Articles of incorporation (if applicable)

- Owner’s tax return, including the Schedule C form

- “Doing business as” documents with owner’s name attached

- Stock ownership documents (if applicable)

- Internal Revenue Service (IRS) form K-1

- Company stock certificates (if applicable)

Step 5: Apply for the Loan or Financing

Once you have identified the most suitable loan or financing option for your business, it’s time to begin the application process. Typically, a loan officer will be your main point of contact throughout this process.

After you submit your small business loan application, prepare to meet in person with the loan officer at your chosen financial institution. During this meeting, you’ll need to make a compelling case for why your business is deserving of the loan and clearly outline your plans for utilizing the funds.

Ensure you have a well-prepared pitch and an organized business plan ready for this meeting. Allocate 10-15 minutes to discuss your planned capital expenditures and your strategy for achieving profitability. Start your presentation with an executive summary that encapsulates the key points and emphasizes your company’s competitive advantages.

If you choose to work with an online lender, you may be able to complete the entire process remotely by communicating with an advisor via phone or email. This can provide a more convenient and often quicker alternative to traditional in-person meetings. Regardless of the method, being thoroughly prepared and clearly articulating your business’s potential will significantly enhance your chances of securing the financing you need.

Get Your Business Loan Faster

The timeframe for receiving approval for financing can vary significantly depending on the lender you choose.

When applying for a small business loan from a traditional bank, especially a large national institution, the approval process can be lengthy, often taking several weeks to over a month. These banks typically have more rigorous and comprehensive review procedures, which can extend the time required for approval.

In contrast, smaller regional banks and community banks usually offer a quicker approval process. These institutions often have more streamlined procedures and a better understanding of the local market, which can result in faster decision-making.

If you opt to apply for a business loan online, you may experience an even more expedited approval process. Many online lenders utilize advanced algorithms and automated systems to review applications, which can lead to approvals within a matter of hours after submission. This speed and efficiency make online lenders an attractive option for businesses needing quick access to funds.

How to Apply for a Business Loan Online: Step-by-Step Guide

Applying for a business loan online through alternative lenders provides a simplified and efficient process. These lenders often have more flexible requirements compared to traditional banks and credit unions. For example, if your business has been operating for only a year and you don’t have an extensive credit history, you can still qualify for a loan with an online lender. In contrast, large banks usually require businesses to have a longer operational history and a more robust credit profile to be considered for approval.

The online application process is designed to be user-friendly and fast, often requiring less documentation and fewer steps. This makes it an attractive option for newer businesses or those with less established credit. Online lenders typically evaluate the overall potential and current performance of your business rather than relying solely on historical data and credit scores. As a result, they can offer more accessible financing solutions to a wider range of businesses, providing the funds needed to grow and succeed.

To apply for a business loan online, follow these steps:

1. Choose an Online Business Loan Type

There are several options available to you if you’re interested in applying for a business loan online, including the options outlined above as well as the following:

Short-Term Loans

Short-term loans are ideal when you anticipate a swift return on your investment. For instance, using a short-term loan to purchase inventory ahead of your peak season is a smart strategy.

These loans usually mature within 18 months or less, allowing you to borrow medium to large amounts (up to $500,000). However, shorter repayment terms often mean higher monthly payments.

-

Do you qualify?*

- In business for 1 year or more

- Annual revenue of $75,000 or more

- Credit score of 540 or higher

*iBusinessLender requirements for borrowers

Merchant Cash Advances

Another online borrowing option is obtaining a merchant cash advance.

This financing method provides a lump sum of cash upfront in exchange for a percentage of the company’s future sales.

Online lenders offering merchant cash advances usually require a minimum credit score of 500. The amount granted typically ranges from $3,000 to $500,000, based on your total cash flow and its consistency.

-

Do you qualify?*

- In business for 4 months or more

- Annual revenue of $100,000 or more

- Credit score of 500 of higher

*iBusinessLender requirements for borrowers

Invoice Financing

Invoice financing, a type of accounts receivable financing, allows businesses to use unpaid invoices as collateral to secure immediate cash.

Businesses facing short-term cash needs, particularly those with high-value outstanding invoices, often opt for invoice financing.

Typically, creditors advance between 75% to 90% of the invoice face value. Once the invoice is paid in full, minus fees, the remaining balance is remitted to the borrower.

Invoice financing can be advantageous for those seeking small business loans with bad credit, as the creditworthiness of your customers is more crucial than your company’s financial health in the approval process.

-

Do you qualify?*

- In business 1 year or more

- Annual revenue of $150,000 or more

- Credit score of 600 or higher

*iBusinessLender requirements for borrowers

2. What You’ll Need to Apply

Most online lenders operate without physical branches, meaning you’ll complete the entire loan application process on their website. With all necessary documents prepared, the application can typically be completed in just a few minutes. Online lenders usually require applicants to provide the following information:

- Income and Annual Revenue: You will need to supply bank statements to support your income and revenue claims. Depending on your business’s industry and the type of financing you seek, lenders may ask for 4-12 months of bank statements.

- Social Security Number: This is required to verify your identity and credit history.

- Business Name and Legal Name: Be aware that your business’s DBA (doing business as) name might differ from its legal name as listed on your formation documents. For instance, a sole proprietorship typically uses the owner’s name, while a partnership includes the names of all partners. Make sure both the DBA and legal names are accurately reflected on your application.

- Business Tax Identification Number: This is essential for identifying your business in tax and financial records.

- Personal Contact Information: Your contact details are necessary for communication and verification purposes.

By having these documents and details ready, you can ensure a smooth and efficient application process. Online lenders streamline the procedure, focusing on ease and speed, which can be particularly beneficial for businesses needing quick access to capital. This approach minimizes paperwork and expedites the review and approval process, allowing you to focus on running your business.

3. Complete the Online Application Process

After you upload your information to the lender’s website, the approval timeline for financing can vary depending on the lender, your qualifications, and the type of loan you are applying for. Some online lenders are able to approve financing within a few hours, and funds can be transferred to your business bank account in as little as 24 hours.

The efficiency of online lenders is largely due to their use of advanced technology and streamlined processes, which allow them to quickly evaluate applications and make decisions. However, the exact timing can depend on various factors, including the completeness and accuracy of the information you provide, as well as the specific requirements of the loan product.

For instance, if you meet all the lender’s criteria and provide all necessary documentation upfront, the process can move very quickly. On the other hand, if additional information or clarification is needed, it might take a bit longer. Nonetheless, online lenders typically offer a much faster turnaround compared to traditional banks, making them a convenient option for businesses that need prompt access to capital.

The Advantages and Disadvantages of Online Business Loans

Pros

✔ Applying for business financing online is far more convenient and expedient than the conventional application process.

✔ At a brick-and-mortar bank, it might take upwards of a month for your application to be reviewed, but online lenders can process a loan application in hours.

✔ Alternative lenders are more likely to approve an application, according to Statista.

✔ For businesses going through a cash crunch, online financing provides accelerated access to cash. Some online lenders can provide business financing the same day you apply.

✔ Between SBA loans, merchant cash advances, short-term loans and more, there are various online business funding options to suit a company’s unique needs and challenges.

Cons

✗ Expedited funding isn’t cheap. If you need cash within a few days, financing from an online lender may translate to higher annual percentage rates (APRs).

✗ You may be facing shorter repayment terms.

✗ Some online lenders tack on hidden fees or terms.

Frequently Asked Questions About Applying for a Business Loan

How do I apply for a business loan with bad credit?

If you’re looking to apply for a small business loan with bad credit, it’s certainly possible, but you should be prepared for less favorable terms. This might include lower funding amounts or higher interest rates. Several financing options are available for borrowers with less-than-perfect credit, such as short-term loans, merchant cash advances (MCAs), and invoice financing.

For those with personal credit scores in the fair (580-669) to very poor (580 or lower) range, taking steps to improve your creditworthiness can significantly enhance your chances of loan approval and better terms. Here are some practical steps you can take:

- Timely Payments: Ensure all bills and debts are paid on time. Consistent, on-time payments are one of the most effective ways to improve your credit score.

- Diverse Credit History: Maintain a diverse mix of credit accounts, such as credit cards, installment loans, and other types of credit. This shows lenders that you can manage different types of credit responsibly.

- Profitability: Ensure that your business is profitable and operating in the black at the time of your loan application. Lenders are more likely to approve loans for businesses that demonstrate financial stability and a positive cash flow.

Read more about tips and financing alternatives for businesses with poor credit scores.

How to obtain a business loan with no money down?

Providing a down payment when securing business financing can significantly reduce the lender’s risk and often results in lower interest rates. However, if you are unable to make a down payment, there are alternative options available. Many lenders are willing to accept collateral in place of a cash down payment. Collateral, which can include assets such as equipment, inventory, or real estate, serves to mitigate the lender’s risk because they can liquidate these assets to recover losses in case of default.

In some cases, lenders may offer financing to eligible business owners without requiring a down payment. However, these loans typically come with less favorable terms. They often involve smaller loan amounts, shorter repayment periods, and higher interest rates. Additionally, lenders might require a personal guarantee, which is a legal commitment from the business owner to repay the debt personally if the business is unable to do so.

For business owners, exploring these financing options requires careful consideration of the terms and the potential impact on their business’s financial health. It’s essential to weigh the benefits of obtaining immediate funding against the costs associated with higher interest rates or the risk of pledging personal or business assets as collateral.

Furthermore, preparing a strong business case and demonstrating financial responsibility can help negotiate better terms. This might include presenting a solid business plan, showcasing consistent revenue streams, and maintaining a positive credit history. By doing so, business owners can improve their chances of securing favorable financing, even without a traditional down payment.

How to obtain a business loan with no collateral?

If you’re looking to obtain an unsecured business loan—financing not backed by high-value assets like property or vehicles—there are several options worth considering:

- Term Loans: These are standard loans with a fixed repayment schedule over a set period. They can be used for various business needs, such as expansion or equipment purchase.

- Business Lines of Credit: This option provides access to a set amount of funds that you can draw from as needed, paying interest only on the amount used. It offers flexibility for managing cash flow or unexpected expenses.

- Invoice Financing: This type of financing allows you to borrow against your outstanding invoices. It can help improve cash flow by providing funds based on the value of your accounts receivable.

- Merchant Cash Advances: This option provides a lump sum payment in exchange for a percentage of your future credit card sales. It is a quick way to obtain funds but typically comes with higher costs.

While traditional lenders may offer unsecured loans to highly qualified borrowers with strong credit histories and financial statements, you are more likely to secure unsecured financing through alternative lenders. These lenders often have more flexible requirements but may offset the increased risk with higher interest rates, shorter repayment terms, and the need for personal guarantees.

Securing an unsecured loan involves understanding the trade-offs, such as potentially higher costs and personal liability. It’s essential to evaluate your business’s financial situation, project future cash flows, and consider the overall impact on your business operations. Additionally, preparing a compelling loan application with a detailed business plan and demonstrating solid financial management can improve your chances of approval and help negotiate better loan terms.

Read more about how to obtain a business loan with no collateral.

How to apply for a business loan after filing for bankruptcy?

If you’re considering how to obtain a business loan after filing for bankruptcy, securing a co-signer can be a viable and immediate solution. A co-signer, usually someone with a higher credit score and a stronger credit history, helps reduce the lender’s risk and increases your chances of approval. However, it’s important to understand that if you default on the loan, both your and your co-signer’s credit ratings will be negatively impacted.

Even with a co-signer, it’s essential to work on rebuilding your credit score. Here are some steps you can take to improve your financial standing:

- Develop a Comprehensive Business Plan: Create a detailed business plan to demonstrate your capability to manage a successful commercial venture. This shows lenders that you have a clear strategy and understand your market.

- Provide a Clear Explanation of Your Bankruptcy: Offer a transparent explanation of the circumstances leading to your bankruptcy. If there were mitigating factors, such as significant medical expenses, detailing these can help lenders better assess your future financial risk.

- Ensure Timely Payments: Make sure all your bills and debts are paid on time. Consistently making timely payments is crucial for rebuilding your credit score.

- Obtain a Secured Credit Card: Consider getting a secured credit card, which requires a cash deposit that serves as your credit limit. Using this card responsibly and paying off the balance each month can help you rebuild your credit history over time.

Read more about steps to get a business loan after filing for bankruptcy.

Are online business loans safe?

Online business loan applications are processed and evaluated electronically via secure web portals that utilize encryption to safeguard your data, ensuring its confidentiality and protection against security threats.

For example, Secure Sockets Layer (SSL) encryption is a standard technology that creates a highly secure connection between the web server and your browser. This technology ensures that all communications and data exchanged between you and the lender remain private and protected from interception.

When choosing an online lender, look for certifications from organizations like TRUSTe. These certifications indicate that the lender adheres to stringent data privacy standards, ensuring that all collected information is kept confidential and secure.

To ensure a safe and reliable borrowing experience, exercise due diligence by thoroughly researching any lender or platform you are considering for your online business loan application. Look for reviews, check for security certifications, and verify the lender’s reputation to ensure your personal and financial information is in good hands.