Curious about securing a small business loan with bad credit? It’s more feasible than commonly assumed.

Many believe that a low credit score automatically disqualifies them from obtaining small business loans. In fact, about 90% of businesses surveyed by the Federal Reserve Banks’ Small Business Credit Survey felt they wouldn’t be approved due to credit issues.

The reasons cited included:

- Excessive debt: 36%

- Low credit score: 33%

- Limited or insufficient credit history: 23%

While guaranteed approval for bad credit business loans doesn’t exist, numerous lenders are open to working with subprime applicants. We can assist you in finding the most suitable secured and unsecured business loans tailored for individuals with bad credit.

Where Can You Get a Business Loan for Bad Credit?

You can explore some of the top bad credit business loans and financing options available through alternative lenders.

Unlike traditional banks, alternative lenders are less risk-averse and offer a variety of choices for online small business loans, even if you have bad credit. They cater to a broader range of business owners as well.

Interestingly, according to the Federal Reserve Banks’ report, nearly 20% of firms in 2021 opted for services from online lenders, fintech companies, or finance firms instead of banks and credit unions.

Because alternative lenders prioritize your business’s overall financial health, your credit score isn’t the sole factor determining approval.

5 Lenders for the Best Business Loans With Low Credit Score Requirements

Here are a few top lenders offering bad credit business loans and financing.

1. Forward Financing

Forward Financing provides revenue-based financing tailored for small business owners with a minimum credit score of 500. Eligible applicants must have at least 1 year of business operation and monthly revenues starting from $10,000. Funding amounts range between $5,000 and $300,000, with estimated repayment terms spanning from 3 to 12 months.

Forward Financing boasts a stellar reputation, earning a 4.8-star rating on Google. It is accredited with an A+ designation by the BBB and holds a strong customer review rating of 4.55 stars.

2. Credibly

Credibly provides merchant cash advances to applicants who have been in business for at least 6 months and maintain a credit score of 500 or higher. Eligible businesses must demonstrate at least $15,000 in average monthly bank deposits, and advances can reach up to $400,000.

In addition to merchant cash advances, Credibly offers business lines of credit for applicants with a minimum credit score of 560 and annual revenue of at least $50,000. They also provide options for equipment financing and accounts receivable financing.

Credibly holds accreditation with the BBB and maintains an A+ rating. The company boasts a strong consumer satisfaction rating on Trustpilot, achieving 4.8 stars.

3. Headway Capital

Headway Capital offers business lines of credit up to $100,000, featuring repayment terms of 12, 18, or 24 months, with the flexibility of weekly or monthly payment schedules. Applicants are required to have at least 1 year of operational history and annual revenue of $50,000 or more.

The company emphasizes a comprehensive evaluation approach for business financing, recognizing that a credit score does not always reflect the overall health of a business.

Headway Capital is highly regarded with a 4.6-star rating on ConsumerAffairs and holds an A+ rating from the BBB. It also enjoys a stellar reputation on Trustpilot, earning a 4.7-star rating from over 1,300 reviewers.

4. The Business Backer

This lender provides small business financing to applicants with a minimum credit score of 550, who have been in business for at least 1 year, and generate a minimum annual revenue of $100,000. They offer various funding options for businesses with bad credit, including loans, lines of credit, and receivables purchases.

The Business Backer maintains a strong reputation, boasting a 4.7-star rating on Trustpilot, a 4.8-star rating on Facebook, and an A+ rating with the BBB.

5. OnDeck

While OnDeck’s website clarifies that the company does not offer specific “bad credit loans,” it emphasizes that having a poor credit score does not necessarily disqualify applicants from obtaining business financing. It promotes its short-term loans as an alternative for borrowers who may have faced challenges securing traditional installment loans or credit cards.

To qualify for a loan or line of credit with OnDeck, applicants must meet certain criteria: at least 1 year in business, a minimum FICO score of 600, and annual revenue of $100,000 or more.

OnDeck holds an A+ rating from the BBB, where it has been accredited since 2008. Moreover, the company enjoys a stellar reputation, earning a 4.8-star rating from over 3,500 Trustpilot reviewers.

-

Getting Business Funding with Bad Credit Through iBusinessLender

If you’re on the hunt for easy business loans for bad credit, consider alternative lender financing. Here’s how to quickly apply for a business loan with bad credit or no-collateral financing through iBusinessLender.

Get Funding in 3 Easy Steps

- Get Preapproved

- Have lenders compete for your business to get the lowest rate.

- Review Your Options

- Receive offers from multiple lenders with one application.

- Get Funded

- Knowledgeable advisors will help you choose the best loan option.

Bad credit? No problem. Find financing options.

- Get Preapproved

What’s Considered a ‘Bad’ Credit Score?

Lenders often categorize a credit score below 580 as “bad” for business loan applicants. But how is this determination made?

Credit reporting agencies analyze your financial data and borrower history to calculate your credit score, which is then categorized from poor to excellent. Lenders assess the level of risk associated with extending a loan to you based on this score. This evaluation influences the maximum funding amount they’re willing to offer, as well as the interest rate and repayment terms they set.

Fair Isaac Corporation (FICO), a leading credit scoring company, categorizes applicants into five tiers based on their credit scores:

| Credit Score | Rating | Impact |

| > 800 | Excellent | While lenders may deny an applicant for other reasons, those with “excellent” credit are rarely turned down. |

| 740 – 799 | Very Good | With a credit score falling in this range, you’re more likely to be approved for a loan and may even have multiple options to compare. |

| 670 – 739 | Good | “Good” credit gives you a solid chance of being approved, but you might not have the luxury of weighing different options. |

| 580 – 669 | Fair | Consumers with “fair” credit may experience difficulty getting approved and incur higher interest rates and other costs. |

| < 580 | Poor | Anyone applying for small business loans with a “poor” credit score is often rejected for various financing options. |

Has your credit score seen better days?

Best 'Bad Credit' Business Loan Types

If your score isn’t where you’d like it to be, that’s OK. Here are some of the most common bad credit business loans and financing options available to you.

Short-Term Loans

Small business loan applicants with lower credit scores may find short-term loans to be a suitable financing option.

Short-term loans, as the name implies, are abbreviated versions of traditional term loans. Once approved, the lender disburses a lump sum that you repay, along with interest, according to a fixed payment schedule over a specified period.

Compared to conventional term loans, short-term loans have a quicker repayment schedule. Typically, these loans mature within 18 months or less.

The Case for Short-Term Loans

Short-term business loans designed for bad credit can be used for various company-specific purposes, offering flexibility without a long-term commitment.

Alternative lenders specialize in providing short-term loans to businesses with bad credit due to their lower risk profile. With shorter repayment periods, there is less time for potential issues that could lead to default—and less capital at risk even if repayment becomes challenging.

However, due to the heightened risk, there are considerations with short-term loans. Payment schedules may require weekly or daily installments instead of monthly payments.

Additionally, approval for these loans is not guaranteed, even for businesses with poor credit. If denied, alternative business funding options tailored for bad credit borrowers are available.

Accounts Receivable Financing

Accounts receivable financing is an alternative funding solution that converts outstanding invoices into immediate cash for your small business. It’s an excellent choice for obtaining the working capital you need while awaiting customer payments—and it’s one of the top options for securing a loan with bad credit.

Here’s how accounts receivable financing typically works:

- You receive a business cash advance, often up to 90% of the total value of invoices you wish to finance.

- Fees accrue weekly on any remaining balance until the invoices are fully paid.

- Once your customers settle their invoices, you receive the remaining amount that was initially withheld.

Accounts receivable financing providers can overlook your credit challenges if your clients have strong credit scores. The invoices themselves secure the advance, making this form of financing self-collateralizing. If you’re seeking a business loan with bad credit and lack traditional collateral, such as property or assets, accounts receivable financing could be the ideal solution for you.

Equipment Financing

If your business requires new equipment or machinery, you may explore lenders that specialize in equipment loans for bad credit. These loans are usually secured by the equipment itself, providing lenders with recourse to reclaim and sell the equipment if you default.

Depending on the lender, you may be able to finance up to 100% of the equipment’s value, although a typical requirement is a down payment of up to 20%.

Even with a poor credit history, opportunities for equipment leasing and purchasing may still exist due to the inherent collateralization provided by the equipment itself.

Merchant Cash Advance

If you’re seeking approval for financing with bad credit, a merchant cash advance (MCA) presents another viable option. Unlike a traditional loan, an MCA involves receiving an advance on your future sales. Depending on your agreement, the lender collects a percentage of your daily credit card sales or withdraws funds directly from your business bank account.

In this short-term financing option for businesses with poor credit, while your business’s creditworthiness is considered, the primary focus is on your sales performance. Lenders prioritize strong sales figures over traditional credit metrics.

A merchant cash advance stands out as one of the top choices for business financing with bad credit, especially for borrowers who have been declined by other lenders.

Business Line of Credit

A business line of credit stands as the most versatile funding solution and ranks among the best options for those seeking small business loans with bad credit.

Approved borrowers gain access to a maximum credit limit, from which they can withdraw funds as needed. Interest accrues solely on the amount withdrawn.

Repayment typically occurs on a weekly or monthly basis until the credit line matures. After repaying the initial amount, borrowers often have the flexibility to draw additional funds. While some options may require collateral, it’s feasible to secure an unsecured business line of credit even with a poor credit score. For instance, iBusinessLender’s lending partners accept applicants with as low as a 560 credit score.

Business lines of credit are versatile, suitable for both daily operational needs and larger-scale projects.

-

Small Business Tip:

Although business lines of credit offer accessible funding for businesses with bad credit, they may not contribute to building your credit score.

Similarly, alternative funding options like merchant cash advances and certain short-term loans often do not report to credit bureaus. As a result, these financing sources do not impact your credit profile by adding to your debt load.

On the positive side, when a new financing arrangement isn’t reported to credit bureaus, it does not reflect as additional debt on your credit report.

If improving your credit score is a priority, you might consider applying for a business credit card instead. Business credit cards are typically reported to credit bureaus and can help establish a positive credit history when used responsibly.

Other Factors Lenders Consider

When alternative lenders evaluate your application for business loans, they assess various factors to determine your eligibility, especially when considering options for bad credit.

While credit scores hold significant weight in the application process, alternative lenders also scrutinize other aspects of your business profile to gauge its financial health.

Here are several factors that can influence lenders’ decisions beyond your credit score:

Annual Revenue

A critical component of your loan application is your business’s annual revenue. High revenue demonstrates to lenders that your business generates sufficient income to repay the loan.

For business owners with bad credit, high revenue can mitigate some of the associated risks.

Annual revenue also influences the loan amount offered by lenders. Typically, the greater the revenue, the larger the loan amount available.

Profitability

Even with high revenue, lenders want to know if your business is profitable.

When lenders see that you have liquid assets to repay a loan, this will help your chances — especially if you’re looking for business funding with bad credit.

Debt Obligations

If your credit is less than excellent and you have existing loans, qualifying for additional loans can be more difficult.

Many lenders are reluctant to issue a “second position” loan. Typically, if you have an existing business loan, your lender will place a Uniform Commercial Code (UCC) lien on your business.

This gives the first-position lender the right to seize assets in the event of default, leaving less collateral (if any) for other lenders to recover their losses.

Cash Flow

Showing that you maintain sufficient funds to cover regular expenses significantly improves your chances of qualifying for business financing, regardless of your credit status.

Ultimately, lenders seek assurance that you have enough cash on hand to meet your debt obligations.

For this reason, they often request 4-6 months of your most recent business bank statements, depending on the type of financing you’re seeking.

Therefore, it’s crucial to focus on boosting your bank account balances if you aim to secure a lower-cost loan with favorable terms, particularly if you’re seeking funding with bad credit.

How Your Business Credit Score Is Calculated (And How to Improve Yours)

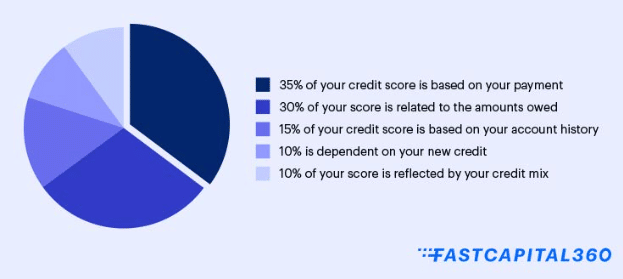

Your credit score is made up of factors such as payment history, amounts owed, new credit and credit mix.

Here’s a percentage breakdown of how FICO scores are calculated.

Payment History

Consistently making your minimum payments on time is the most crucial factor affecting your credit score. Even a single missed payment can raise a red flag when applying for small business loans with a poor credit score.

To improve your credit score, ensure all payments are submitted on time.

Amounts Owed

Often referred to as your “utilization ratio,” the amounts owed represent the percentage of your available credit that you are using. Lenders look for evidence that you can manage debt responsibly without becoming overextended.

Review your credit report to check your payment history and see the outstanding balances on individual accounts.

Account History

This is calculated based on the average age of your accounts and the most recent activity. Creditors prefer to see a long, positive history of managing multiple active accounts.

New Credit and Credit Mix

Opening several new accounts of the same type simultaneously can negatively impact your credit score, as it is seen as risky behavior. On the other hand, successfully managing various types of credit — such as a mortgage, auto loan, and credit card — demonstrates financial responsibility.

If you are working to rebuild your credit, keep track of your progress by periodically checking your credit score.