When businesses require funds, securing working capital swiftly is essential. Obtaining a short-term cash flow loan can be instrumental in overcoming financial shortages.

Let’s explore the fundamentals of cash flow lending, eligibility criteria, and the lenders that offer cash flow financing.

What Is a Business Cash Flow Loan?

A small business cash flow loan allows you to borrow funds against revenue you expect to earn in the future. This type of financing is quick to fund and provides the working capital needed to fill cash flow gaps.

Related: Bad Credit Business Loans? These Are Your 5 Best Options

How Does a Cash Flow Loan Work?

Cash flow lending differs from asset-based loans in that it doesn’t necessitate collateral. Instead, the funds are secured against the company’s projected revenue. Typically, a personal guarantee from the owner and any partners is also required. This means that if your business cannot repay the loan, your personal or business assets may be used to settle the outstanding debt.

A cash flow loan is structured for swift repayment or refinancing.

As commercial cash flow lending encompasses various funding programs, the qualification criteria can vary among lenders. However, businesses with robust sales are often eligible for a cash flow loan, even if their credit score is 580 or lower.

Business Cash Flow Loans vs. Asset-Based Loans

Regardless of the financing option you pursue, lenders assess your cash flow as a critical factor. However, leveraging your assets is another common method to secure a loan.

The primary distinction between asset-based loans and cash flow loans lies in the use of collateral. Asset-based loans are backed by assets pledged by the business owner, which can include expected income from accounts receivable, company-owned real estate, equipment, and inventory.

Another key difference is the processing time. Asset-based loans typically require around 30 days for the lender to evaluate the applicant’s request thoroughly. This evaluation includes reviewing balance sheets and assessing the pledged collateral.

In contrast, cash flow loans undergo a quicker underwriting process. Lenders use metrics like earnings before interest, taxes, depreciation, and amortization (EBITDA) combined with a credit multiplier to evaluate the application swiftly, considering both external factors and the business’s own risk profile.

When to Use a Cash Flow Loan?

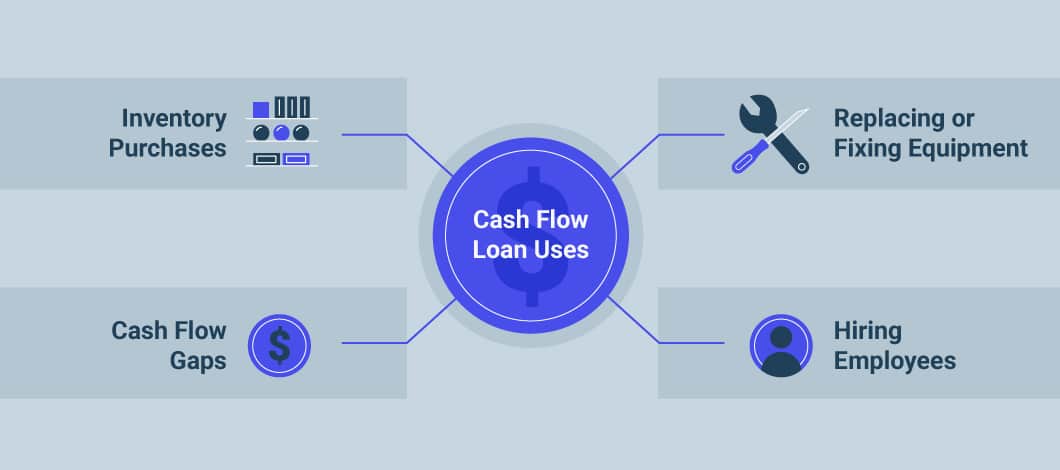

A cash flow loan can address various short-term business needs, such as:

- Inventory purchases: Cash flow loans are ideal for replenishing seasonal reserves, purchasing in bulk for discounts, or filling gaps in your product line. They can also help businesses fulfill unexpected large orders by securing sufficient inventory.

- Equipment replacement or repair: When critical equipment fails, a cash flow loan provides immediate access to funds needed for repairs or replacements.

- Managing seasonal downturns: Even during slower retail seasons, operational expenses continue. A cash flow loan can provide financial support to sustain your business through periods of reduced sales.

- Hiring additional employees: With business growth comes the need for expanding your workforce. A cash flow loan can cover the costs associated with hiring new employees to meet increasing demands.

Do you need a cash flow loan for your small business?

5 Cash Flow Financing Options

The term “cash flow loan” is an umbrella term that can include several types of business financing options:

1. Business Line of Credit

This type of small business cash flow lending offers a flexible funding solution that adapts to your evolving business needs. It allows you to withdraw funds as needed, with interest payments applied only to the amount borrowed.

With a revolving credit line, the available funds replenish as you make repayments, similar to how a credit card works. Lines of credit can be secured with collateral or unsecured.

At iBusinessLender, the terms for a business line of credit include:

- Loan Amount: Up to $250,000

- Estimated Repayment Terms: 6 months–3 years

- Interest Rate: Starting at 8%

- Speed of Funding: As fast as 1 day

2. Merchant Cash Advance

A merchant cash advance (MCA) technically isn’t classified as a loan, but it serves as a financing option to bolster short-term business cash flow.

An MCA provider offers a lump sum upfront based on projected future earnings. Instead of an interest rate, you pay a factor rate, and repayment is made through a percentage of your daily sales, often with automatic daily withdrawals.

One notable advantage of an MCA is its quick approval and funding process, typically within 24 hours.

Here are iBusinessLender’s terms for an MCA:

- Financing Amount: Up to $500,000

- Estimated Repayment Terms: 3–24 months

- Factor Rate: Starting at 1.10

- Speed of Funding: As fast as the same day

3. Unsecured Business Term Loan

Unsecured business term loans provide a lump sum of capital that is repaid over a specified period. These loans do not require collateral and are typically used for substantial investments such as equipment purchases or debt consolidation. Term loans often feature lower interest rates compared to other types of cash flow financing.

Here are iBusinessLender’s terms for unsecured business term loans:

- Loan Amount: Up to $250,000

- Estimated Repayment Terms: 1 year–5 years

- Interest Rate: Starting at 7%

- Speed of Funding: As fast as 1 day

4. Short-Term Loans

Short-term business cash flow loans provide a lump sum of capital similar to longer-term loans, but typically in smaller amounts and with shorter repayment periods. These loans are typically repaid within 18 months or less, often through daily or weekly payment schedules.

iBusinessLender terms:

- Loan Amount: Up to $500,000

- Estimated Repayment Terms: 3–18 months

- Interest Rate: Starting at 10%

- Speed of Funding: As fast as the same day

5. Invoice Financing

Another alternative for obtaining a business loan based on cash flow is invoice financing. If you operate in the business-to-business sector and require immediate funds, you can use your unpaid invoices to secure quick cash. Invoice financing providers typically advance 70% to 90% of qualifying accounts receivable amounts.

iBusinessLender terms:

- Financing Amount: Up to 80% of receivables

- Estimated Repayment Terms: Until receivables are paid by customer

- Factor Rate: Starting at 1.02

- Speed of Funding: As fast as same day

How to Get a Cash Flow Loan

You’ve determined that cash flow financing is the optimal choice for your business, but do you meet the qualifications? First, let’s explore the factors lenders evaluate when assessing your application, and then identify the type of lender that suits your needs best.

What Factors Do Cash Flow Lenders Evaluate?

Securing approval for small business cash flow lending is typically easier than obtaining a conventional loan, making it a readily accessible financing option for many businesses.

Here are several factors lenders take into account when considering approval for a cash flow loan:

Debt-to-Income Ratio

During the underwriting process, lenders assess your existing debt and your debt-to-income ratio (DTI).

This ratio evaluates your capacity to manage additional debt and illustrates how effectively you can repay it. A lower DTI indicates a higher likelihood of approval for financing.

Projected Revenue Growth

Underwriting primarily relies on past performance to evaluate your application. This historical data, along with your planned use of funds, will impact projections for your revenue growth. These projections help lenders estimate the amount you might qualify for.

For seasonal businesses, forecasting future revenues can be more complex. In such cases, lenders may request financial records from the corresponding months of the previous year to ensure that a busier season is approaching during the repayment period of your loan.

Operating Cash Flow

Operating cash flow is a metric that illustrates how much revenue a company generates from its core operations, such as manufacturing and the sale of goods or services.

Also referred to as net cash from operating activities, operating cash flow focuses on regular business operations and excludes non-recurring expenses like long-term capital investments or one-time costs.

Lenders use your operating cash flow to gauge your business’s financial stability, determine the amount they can lend you, and assess your ability to make repayments. Understanding your average cash flow levels and any seasonal variations (for example, reduced income during winter for a garden center) helps lenders evaluate the risk of lending to you.

In essence, a robust operating cash flow enhances your chances of securing a larger loan amount at favorable interest rates.

Cash Flow Lending Sources

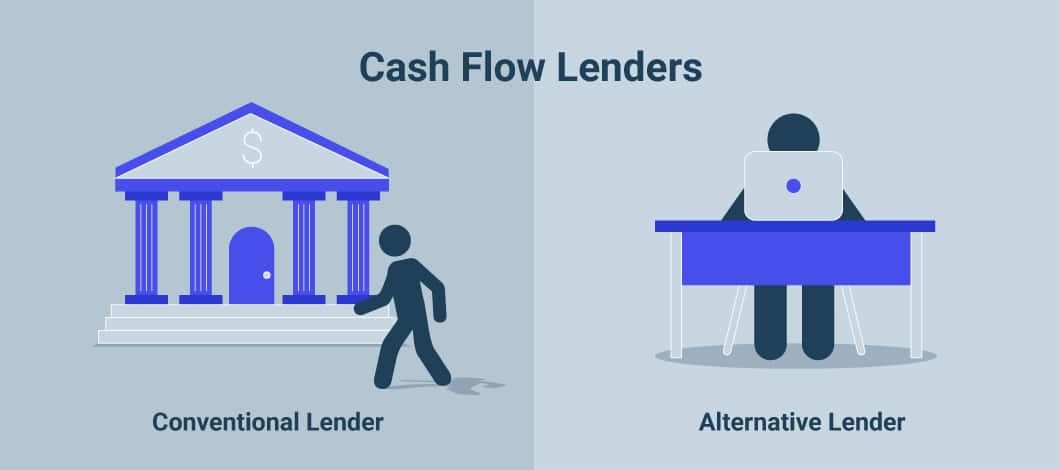

You have 2 major options when looking for short-term cash flow loans and other financing — conventional and alternative, or online lenders.

Conventional Lenders

Banks and credit unions are reliable choices for term loans or business lines of credit. These traditional lenders typically offer substantial funding amounts, lower interest rates, and extended repayment terms. However, these favorable terms come with stringent eligibility criteria.

Banks typically seek applicants with high revenue streams, good to excellent credit scores (670 or higher), and extensive credit histories. They also prefer applicants who have an existing relationship with the bank. Meeting these criteria can be challenging for some small businesses, especially those with limited revenue or a short credit history.

Moreover, the application process for bank loans can be lengthy and demanding, requiring comprehensive details and documentation about both your business and personal finances. The timeline from application submission to approval and funding can span several weeks to over a month.

Alternative Lenders

Alternative online lenders are more open to risk than traditional lenders, making working capital accessible to a broader range of business owners, including those with poor credit. These lenders assess a business’s financial health beyond just credit scores.

In addition to evaluating your current cash flow, these lenders typically require the following information:

- Details about your business

- Information about the primary business owner(s)

- Your doing-business-as (DBA) name, if applicable

- Several recent bank statements

Once you have gathered this information, you can complete the application entirely online on the lender’s website, often in a matter of minutes.

Depending on the lender and the type of cash flow loan you apply for, funds can be deposited into your bank account on the same day of approval. However, the faster processing and easier access to funds mean that these lenders are assuming a greater risk. Consequently, some cash flow financing options may involve more frequent payment installments and shorter repayment periods compared to loans from traditional lenders.

What Are the Downsides to Small Business Cash Flow Loans?

While a commercial cash flow loan can help you meet various business funding needs, there are potential downsides to consider before deciding whether this type of financing is right for you and your business.

Higher Rates and Fees

Cash flow-based lending focuses primarily on your business’s future cash flow rather than a broader assessment of its financial health, making it a riskier proposition for lenders. As a result, cash flow loans typically carry higher interest rates and fees due to their shorter repayment terms.

Personal Guarantee

Personal guarantees are frequently required in various business financing options, including cash flow loans. Additionally, some cash flow lenders may request a lien to secure their investment.

While these practices are standard among many lenders, it’s essential to carefully evaluate whether you and/or your business partner would be capable of repaying the balance of your cash flow loan in the event of default.

Automatic Payments

Cash flow lenders frequently mandate automatic payments from borrowers, which can pose challenges during periods of cash flow instability. Nevertheless, this requirement helps mitigate risk for financing providers.

Depending on your specific financing agreement, payments may be deducted on a daily, weekly, or monthly basis. Additionally, installment amounts may remain fixed or vary based on your credit and debit card sales.

Is a Cash Flow Loan Right for Your Business?

In 2021, 62% of small businesses sought financing to cover operating expenses, a notable increase from 43% in 2019, as reported by the Federal Reserve Banks’ Small Business Credit Survey. Clearly, there is a growing demand for cash flow loans.

When considering whether to pursue this type of financing, ask yourself the following questions:

- Are you entering a slow period?

- Would a short-term cash flow loan facilitate your ability to say yes to more clients and business opportunities?

- Could a business cash flow loan save you money on necessary inventory purchases?

- What would the return on investment be from your cash flow loan?

- What would your business outlook look like if you didn’t seek a cash flow loan?