Curious about securing a business line of credit? It’s simpler than you might imagine.

Follow our step-by-step guide on how to apply for a business line of credit. Explore the various types of lines of credit available, and learn what you’ll need to begin.

Secured vs. Unsecured Lines of Credit

There are various types of lines of credit to consider: long-term, short-term, secured, and unsecured, each with varying interest rates.

Secured lines of credit require collateral, such as high-value assets, to secure the loan against default risk.

Unsecured lines of credit, on the other hand, do not require collateral. However, to mitigate risk, lenders may offer lower credit limits and higher interest rates.

Unsecured lending often features a quicker approval process and requires less paperwork compared to secured loans.

Before applying, decide which type of small business line of credit best suits your needs.

How to Qualify for a Business Line of Credit

Qualifying for a new business line of credit depends on several key factors. Many lenders require your business to have been operational for at least a year and to generate a minimum annual revenue of $200,000. A credit score of at least 560 is also commonly required when applying for a business line of credit. It’s essential to thoroughly research the specific requirements of multiple lenders before submitting your applications.

If you opt for a secured business line of credit, you’ll need assets to use as collateral. These assets can include:

- Personal or business property

- Personal or company vehicles

- Business inventory or equipment

- Accounts receivable

Ensure you assess the collateral requirements carefully and understand the implications before proceeding with your application.

Related: Business Loan Requirements

How to Apply for a Business Line of Credit

When you’re ready to apply for a line of credit, you’ll need to follow a few steps. Here are ways to increase the odds when you’re wondering how to get approved for a business line of credit:

1. Check Your Credit Score

Your credit score plays a critical role in qualifying for a business line of credit and can significantly impact your chances of approval. Maintaining a strong credit score is one of the most effective ways to secure favorable rates and terms for your business line of credit.

Ideally, you should aim to apply for a low-interest line of credit with a credit score categorized as fair or better, although some lenders may consider applicants with lower credit scores. According to Experian, FICO credit scores, widely used by lenders, fall into the following categories:

- 300-579: Very Poor

- 580-669: Fair

- 670-739: Good

- 740-799: Very Good

- 800-850: Exceptional

Typically, if your FICO score is 600 or below, you should anticipate higher annual percentage rates (APR) on your loan or credit line. Online lenders often provide viable options for obtaining a small business line of credit with bad credit or for new businesses with limited operational history.

2. Gather Your Documents

When you’re prepared to apply for a business line of credit, gathering the necessary documents and identification is essential for a smooth application process.

While online lender applications are generally more streamlined compared to traditional lenders like banks and credit unions, creditors typically require specific information when you apply for a business line of credit. These may include:

- Tax returns

- Bank statements

- Cash flow statements (such as balance sheets and profit-and-loss statements)

- Articles of incorporation (if applicable)

- One form of government-issued identification

While not every lender will request all of these documents, it’s wise to gather them in advance during the pre-application phase to expedite the process.

3. File the Application

Now that you’ve chosen a lender and gathered all the necessary documents, you’re ready to begin your business line of credit application.

If you’re opting to apply through a bank or credit union, you may need to schedule an appointment with a loan officer at their branch.

For online applications, the process can be completed in just a few minutes. Once you’ve submitted your application, you’ll receive confirmation that the lender has received it and it’s now under review. The lender’s algorithm will assess your application, review your business line of credit qualifications, and initiate the underwriting process.

Many nonbank lenders can provide a funding decision within a day. However, if you’re applying through a bank or for a secured loan, the process may take longer.

Get Your Business Loan Faster

Why Open Up a Business Line of Credit?

Establishing a business line of credit appeals to entrepreneurs and business owners operating in dynamic and fast-paced environments.

Opting for a credit line over a loan or advance offers several advantages:

- Highly flexible financing

- Revolving credit that can be accessed repeatedly

- Acts as a valuable safety net for unexpected expenses or seizing business opportunities

- Helps smooth out cash flow fluctuations typical in seasonal or industry-specific businesses

- Often features lower interest rates compared to credit cards

- Provides a balanced alternative between term loans and credit cards

Opening a small business credit line is often favored by entrepreneurs seeking a flexible, straightforward borrowing solution.

According to the Federal Reserve Banks’ State of Small Business Credit report, 71% of businesses surveyed were approved when applying for a business line of credit.

Cash-Flow Management

Effective cash-flow management stands out as a primary advantage of business credit lines.

Small business lines of credit serve to cover expenses or make critical purchases during periods of low cash flow. For instance, a line of credit can facilitate timely inventory purchases precisely when they are needed. This contrasts with buying inventory well in advance and waiting until business conditions improve to procure more.

Line of Credit Interest Rates and Tax Benefits

While lines of credit may lack the perks and promotional incentives of credit cards, they often feature lower APRs. The best small business lines of credit typically start with rates just above the prime rate.

These credit lines offer substantial credit limits, making them ideal for financing expenses reaching five or six figures.

Moreover, interest paid on a business line of credit used for legitimate business expenses may be tax-deductible. This potential tax benefit can result in annual savings on your tax returns. For detailed guidance on tax implications, consult with your accountant or tax adviser when exploring how to secure a business line of credit.

Should I Get a Business Loan or Line of Credit?

Indeed, lines of credit and loans are the most frequently sought forms of financing by companies, as reported by the Federal Reserve Banks’ Survey of Small Business Credit, with 89% of respondents indicating their preference. However, determining which option is best suited for your business depends on various factors.

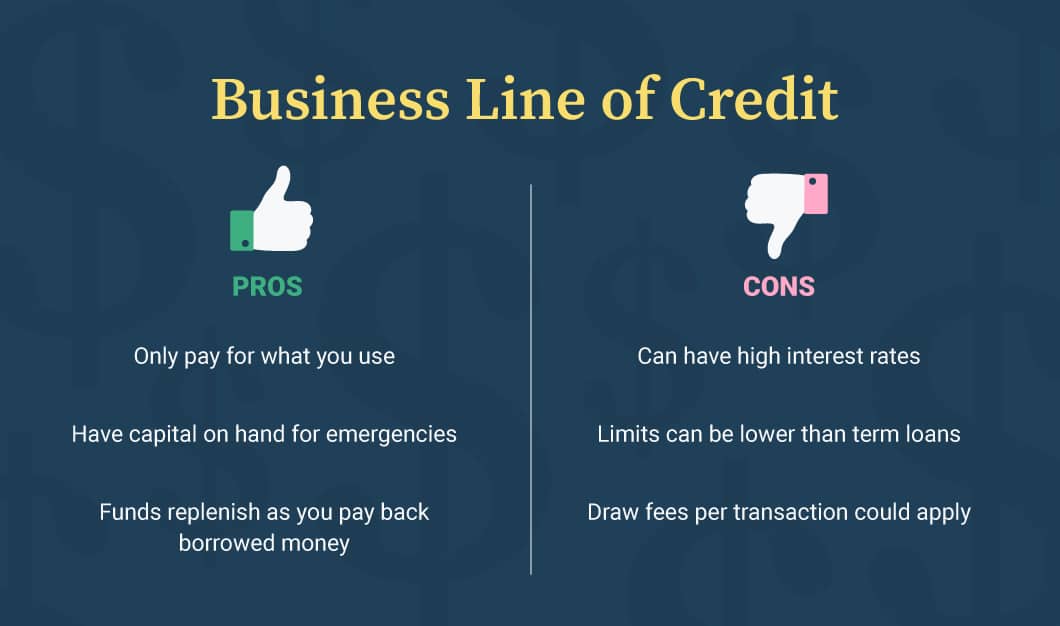

Business Lines of Credit

For short-term financial needs, credit lines provide a practical solution. Unlike term loans, revolving credit lines allow businesses to withdraw funds as needed and repay them according to their cash flow.

Think of a business line of credit as a renewable source of capital that can be accessed up to a set limit. Similar to credit cards, revolving credit lines can be used, repaid, and reused as necessary. Interest is only charged on the amount borrowed.

Moreover, credit lines are ideal for business owners who frequently encounter unexpected expenses. Unlike term loans, funds repaid from the credit line become available again for future use.

Furthermore, with a credit line, there’s no need for recurrent applications and the lengthy approval process typically associated with annual renewals.

Business Term Loans

A business term loan provides a lump-sum amount that the borrower must repay with interest through regular installments. Some agreements may include a prepayment penalty if the loan is fully paid off before its scheduled amortization period.

Term loans are ideal for financing fixed, one-time expenses. They are most suitable when you require the entire loan amount upfront.

Once a term loan is repaid, you must reapply if you need additional funds.

Where to Find the Best Online Business Lines of Credit

Conventional Lenders

If your business has a solid credit history and is well-established, traditional banks and credit unions often offer the most competitive interest rates and favorable repayment terms. Although the application and funding process with these institutions may be slower compared to online lenders, meeting their stringent requirements can lead to cost savings through lower interest rates, higher credit limits, and extended repayment periods.

PNC Bank is recognized as one of the top choices for business lines of credit, providing up to $100,000 in unsecured funding and up to $3 million for secured credit lines. Known for its reputable service, PNC Bank holds an A+ rating with the Better Business Bureau and boasts a 3.9-star rating on Bankrate.

Online Lending Marketplaces

If you need rapid access to funds, have a credit score ranging from the 500s to low 600s, and prefer a straightforward application process, exploring an online lending marketplace could be your best option for obtaining a business line of credit.

Using a single, straightforward application, you can connect with multiple financing providers through the marketplace, streamlining the process of finding suitable lenders whose eligibility criteria align with your business’s needs. Additionally, these platforms often provide resources to assist business owners in navigating the application process efficiently.

-

iBusinessLender’s Partner Lenders

If you’re in the market for working capital, iBusinessLender’s nationwide network of lenders can help. Apply online in just a few minutes and get the financing you need as fast as the same day.

Direct Alternative Lenders

You could also apply directly with an online lender. Here are a few direct alternative lenders offering business lines of credit.

| Lender | Maximum Credit Line | Repayment Term | Borrower Requirements |

| BlueVine | $250,000 | 12, 18 or 24 months |

|

| OnDeck | $100,000 | 12 months |

|

| Kapitus | $250,000 | Varies |

|

Discover Your Best Business Loan Options

How to Get a Business Line of Credit That’s Best for Your Organization

Flexibility and adaptability are crucial in business, and small business lines of credit provide valuable support in these areas. Whether you need funds for unexpected expenses, to navigate a cash flow challenge, or to seize a sudden opportunity, a business line of credit can be a valuable resource.

If you’re weighing the options between a business loan or line of credit, remember that business lines of credit offer flexibility and accessibility, making them suitable for both new businesses and growing enterprises.

For entrepreneurs who need quick access to funds and can’t afford to wait through the traditional application processes of banks and credit unions, applying for an online business line of credit may be the best solution.