Numerous small business owners opt for inventory financing when their existing working capital doesn’t fully cover product purchases upfront. Here’s what you need to understand about the various types of inventory-based loans, their advantages for your business, and the process of applying for inventory funding.

What Is Inventory Financing?

Inventory financing encompasses loans, lines of credit, or other financial solutions that small businesses utilize to acquire products and maintain stock. This type of funding is particularly beneficial for businesses that rely on inventory, such as retailers and wholesalers.

Inventory business loans enable businesses to purchase stock in large quantities, capitalize on vendor discounts, or manage inventory acquisitions during seasonal fluctuations in cash flow.

How Inventory Financing Loans Work

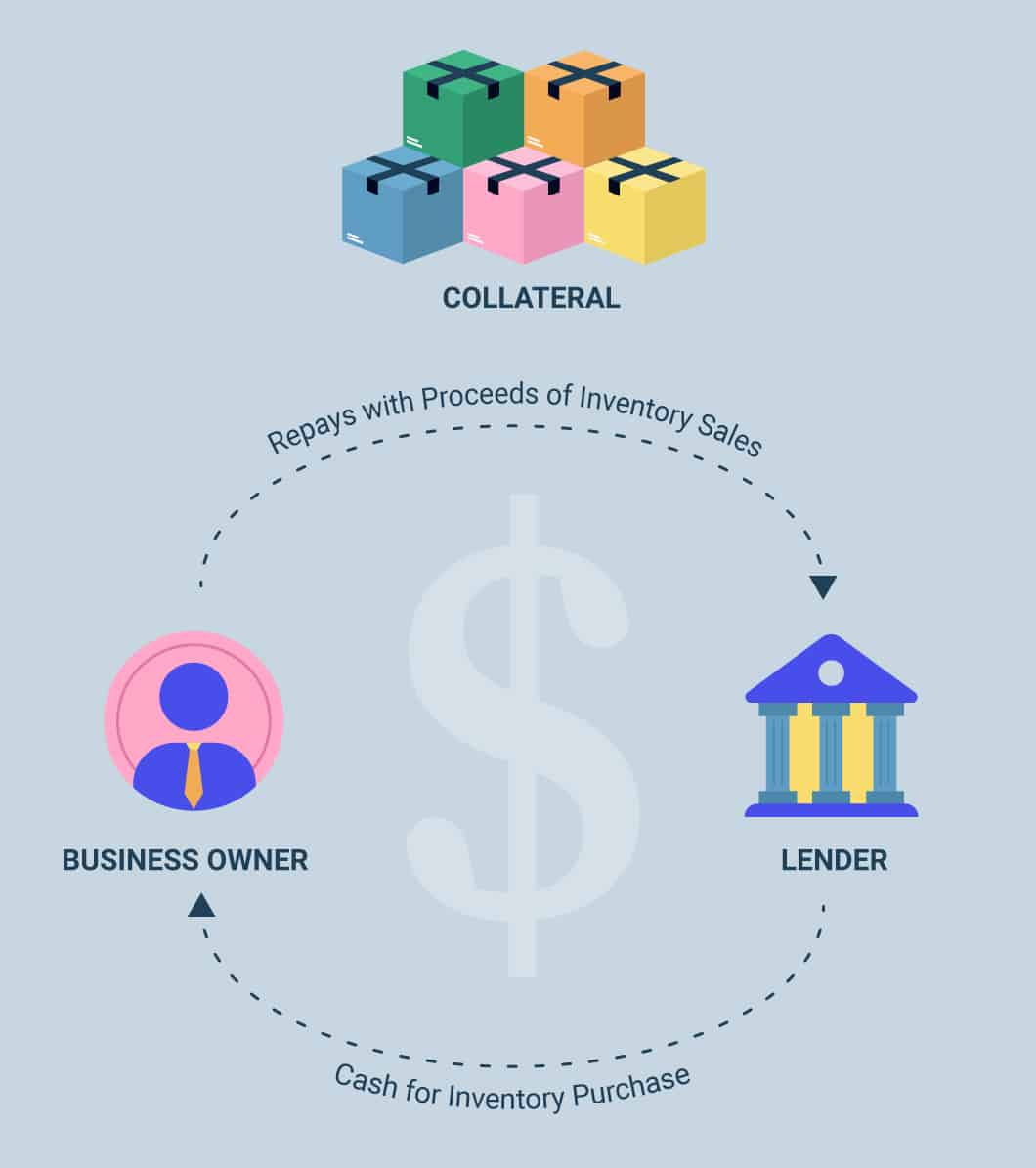

The products purchased with inventory funding serve as collateral to secure the financing, akin to equipment financing. This type of loan provides opportunities for small businesses that may lack assets to secure other forms of funding.

Throughout the repayment period, the inventory remains available for sale, with the generated revenue used to repay the loan. Consequently, lenders bear the risk if products do not sell as expected. In cases where a borrower misses payments or defaults, the lender has the option to repossess and liquidate the inventory to recover the funds.

Due to this risk, inventory financing companies typically do not finance the full value of the products. Instead, businesses are typically eligible to receive between 50% and 80% of the liquidation value, which may be lower than the initial purchase price.

Related: Secured Business Loans

Types of Inventory Financing

If you think inventory financing is the best option for your business, there are 3 types to consider: an inventory loan, an inventory line of credit or vendor inventory financing.

Inventory Loan

An inventory loan provides your small business with funding from a lender specifically to finance your stock supply. Due to the rapid turnover of retail inventory, opting for a short-term inventory loan is often more practical than a longer-term financing option.

Inventory business loans can be obtained from banks or alternative lenders. The rates and terms of these loans depend on factors such as the lender’s policies, the liquidation value of your inventory, and to some extent, your creditworthiness and the overall financial health of your business.

Inventory Line of Credit

An inventory line of credit offers borrowers access to a pool of funds that they can utilize as needed. The credit line is secured by the company’s inventory, whether it is currently in stock or planned for purchase.

Inventory lines of credit typically operate on a revolving basis, allowing funds to be replenished as borrowers repay what they have used.

Related: How to Get a Business Line of Credit (Plus Where to Look)

Vendor Inventory Financing

Rather than obtaining inventory financing through a lender and then purchasing your stock, with vendor inventory financing you get lending directly from your vendor.

There are 2 types of vendor inventory financing:

Debt Financing

- Vendor provides a loan for the purchase of inventory

- You repay the loan with interest using your sales revenue

Equity Financing

- Vendor supplies goods in exchange for stock in your company

- While you won’t have to repay them for the cost of the inventory, your vendor will become an equity shareholder in your company — meaning they’ll have a say in future decisions the company makes

Vendor inventory financing is a suitable choice for businesses that either do not qualify for alternative funding options or prefer not to incur debt from a traditional lender. This form of inventory financing can also foster a closer relationship between your business and the vendor.

However, interest rates associated with vendor debt inventory financing may be higher compared to rates offered by traditional lenders.

Inventory Financing Rates

Inventory financing rates vary depending on whether you secure a loan specifically for purchasing product stock or opt for another type of funding solution for your inventory needs.

Due to the heightened risk associated with inventory lending, interest rates tend to be higher. Lenders must ensure they can recover value from the products in case of default, which can be challenging. Therefore, increasing interest rates helps mitigate this risk. It is not uncommon for inventory financing rates to range in the teens or even exceed 20%.

Other types of inventory business loans and lines of credit may offer lower rates but could require additional collateral to secure the financing. When deciding on the right funding option for your small business, consider your priorities carefully.

Do you need a loan to buy inventory?

Pros and Cons of Inventory Financing

As with other funding options, inventory financing has advantages and disadvantages. Let’s break them down.

Pros of Inventory Financing

It’s always a good idea to weigh the advantages and disadvantages of any business decision. Here are a few of the positives of using inventory financing.

Helpful for Seasonal Businesses

If you operate a seasonal retail store and need to purchase inventory but lack the upfront cash flow, inventory business loans can provide a solution.

For instance, a garden center earns the majority of its revenue during the spring and summer months, when customers are eager to enhance their outdoor spaces. During slower periods, however, the center may struggle to accumulate enough funds to stock up adequately.

Inventory business loans allow you to bolster your working capital by financing the inventory necessary to meet customer demand.

Renewable Funding Source

A business line of credit serves as a flexible funding option for businesses with ongoing working capital requirements. When utilized for inventory financing, it becomes a renewable source of funding ideal for expanding retail operations.

The ability to withdraw additional funds as needed, after repaying the borrowed amount to inventory financing lenders, makes it an attractive choice for retail businesses seeking continuous and adaptable access to capital.

No Risk to Personal Assets

While it is feasible to obtain unsecured business loans for purchasing inventory, many lenders typically require some form of collateral for loan approval. This often entails putting personal assets such as money, vehicles, or a house at risk in case of default.

With inventory business loans, however, the products themselves serve as collateral. This means you do not need to be concerned about losing personal assets, unless you have signed a personal guarantee as part of the loan agreement.

Less Emphasis on Credit Score

When assessing financing applications, lenders typically review both personal and business credit scores. However, with inventory business loans, the focus shifts away from your credit score because the inventory itself serves as collateral.

The primary consideration for lenders is your ability to sell the product and generate revenue to repay the loan. While securing a loan with poor credit can be challenging, having a high credit score (e.g., 700+) is not necessarily a requirement. In some instances, it may even be feasible to obtain inventory financing without undergoing a credit check.

Cons of Inventory Financing

Although the advantages are attractive, there are a few reasons why inventory financing isn’t the best option for some businesses.

Higher Rates

Lenders manage their risk by imposing higher interest rates on business inventory loans, which can result in higher overall costs for this type of financing. While some inventory loan rates can be less than 10%, they can also reach nearly 100%, depending on the lender and the specifics of your product line.

It’s important to note that the type and value of your inventory significantly influence the rates you qualify for. If your inventory is perishable or difficult to sell, lenders may charge steeper rates to compensate for the increased risk.

Shorter Terms

Lenders aim to minimize their risk, often resulting in shorter terms for inventory loans. This approach ensures that in the event of default, products can be swiftly liquidated. Offering term lengths typically between 6 to 12 months reduces the likelihood of lenders holding onto outdated items that are difficult to sell.

While shorter terms can benefit those preferring not to tie up their capital long-term, they also lead to higher payment amounts.

Stricter Approval Standards

Inventory financing lenders are cautious about providing funding if they doubt the product’s potential to sell based on industry trends, sales projections, or demand. To mitigate risk, lenders often impose restrictions on the use of small business inventory loans. Products that are prone to quick obsolescence or difficult to liquidate are typically ineligible.

Examples include computer equipment, perishable goods, and certain seasonal items that may lack future value, such as New Year’s Eve decorations featuring the current year.

Longer Business History Preferred

Inventory financing companies prefer businesses that demonstrate a consistent ability to sell inventory rapidly and achieve healthy profit margins. Typically, you need at least one year of operational history to demonstrate this capability. If your business has less than a year of history or if you are a startup seeking inventory financing, you will need to consider alternative financing options.

How to Get Inventory Financing

When you’re ready to get an inventory loan for your small business, follow these steps:

1. Compile Financial Documents and Business Information

When applying for an inventory financing loan, lenders will want assurances that you have a healthy inventory turnover. Have the following information on hand to give your lender a full view of your small business finances and operations:

- Balance sheets

- Profit-and-loss statements

- Sales forecasts

- Cash flow statement

- Personal and business tax returns

- Bank statements (often the past 4-6 months)

- Inventory lists and management records

- Personal information and information about any co-owners or other business partners

2. Complete and Submit an Application

The application process for inventory financing can vary significantly. Traditional lenders like banks and credit unions typically have a more extensive process, requiring substantial paperwork and possibly an in-person meeting before approval.

In contrast, alternative lenders offer a streamlined experience where you can complete an online application and upload necessary documents within minutes.

3. Await Final Approval and Make Your Decision

The time it takes from application to approval varies depending on the lender. Conventional lenders may take several weeks or even over a month to thoroughly review your application.

On the other hand, alternative lenders often approve applications within days and sometimes provide funding on the same day of approval. However, bear in mind that using inventory as collateral may involve lenders conducting audits of your business’s sales and inventory operations.

Upon approval for inventory financing, carefully review the terms of the agreement. Pay particular attention to the inventory loan rate before finalizing the agreement.

Related: Why APR Is the Wrong Metric

Inventory Loan Alternatives

Loans secured by inventory aren’t the answer for every small business. The following are some popular alternatives to traditional inventory financing.

Short-Term Loans

Short-term loans, as implied by their name, resemble term loans but with abbreviated repayment periods. Unlike loans spanning years, these loans can have terms as brief as 3 months and are versatile for various business purposes, including inventory purchases.

The condensed repayment schedules increase approval prospects for businesses with less-than-excellent credit. Many online lenders specialize in short-term loans, making them an advantageous option for small businesses seeking rapid access to funds for inventory financing.

Merchant Cash Advance

This alternative to inventory financing isn’t a traditional loan but rather funding provided based on future sales. Known as a merchant cash advance, providers like iBusinessLender’s lending partners may approve up to $500,000. This funding can be used for purchasing inventory, and repayment is structured through daily or weekly installments. Payments are typically deducted as a percentage of future sales or via Automated Clearing House (ACH) withdrawals.

Accounts Receivable Financing

If your business operates in the business-to-business sector and faces cash flow challenges while waiting for invoice payments, accounts receivable financing offers a solution for funding inventory purchases. With this alternative to traditional inventory financing, lenders advance a percentage of your outstanding invoices—often up to 80% or 90% of their total value. You receive the remaining amount, minus lender fees, once the invoices are fully paid.

SBA CAPLines

If you’re planning to purchase inventory for a retail store or another small business with seasonal sales peaks, consider the Small Business Administration’s Seasonal CAPLine.

This SBA inventory financing option is part of the 7(a) loan program and functions as a business line of credit, offering a maximum credit line of $5 million. These loans are specifically designed to fund inventory purchases ahead of busy seasons. They feature maturity lengths that can extend up to 10 years, making them an excellent choice for businesses seeking a longer-term financing commitment.

Business Lines of Credit

If you require immediate inventory financing or lack the creditworthiness for SBA approval, alternative lenders can still provide you with a business line of credit.

Opting for this option allows you to withdraw funds from the line of credit to cover various operating expenses beyond inventory, offering flexibility that can benefit growing small businesses.

The speed and accessibility of funding from online lenders make business lines of credit particularly appealing. Utilizing an online lending marketplace like iBusinessLender enables you to submit a single application to multiple lenders, significantly reducing the time spent on multiple applications.

Moreover, qualification requirements are generally lower compared to SBA, bank, and traditional inventory loan lenders, offering opportunities for businesses with lower credit scores to secure financing.