An online business loan provides a convenient and expedited solution for business owners who either do not qualify or cannot afford to wait for funding from traditional lenders like banks and credit unions.

However, many business owners may not fully understand how online loans operate or how lending marketplaces can serve as a valuable resource to secure funding for their small business.

This guide will explore various types of financing options available, highlight reputable online business lenders, and provide insights into obtaining a small business loan online.

What Is an Online Business Loan?

This term refers to a wide range of financing options, including term loans, business lines of credit, merchant cash advances, and others, all of which are facilitated entirely online by online business lenders. Generally, these lenders have less stringent requirements, making online business funding more accessible to small companies that may not qualify for traditional financing.

Best Small Business Loans Online: At a Glance

You’ll find plenty of options when you’re looking for online funding for a small business. Here’s an overview of some of the best online business loans and financing options you can apply for:

| Loan Type | Description |

|---|---|

| Term Loans | The best option for business owners with an established credit score. |

| Short-Term Loans | Ideal for covering a temporary one-time expense. |

| SBA Loans | Good for profitable businesses that have been operating for at least 2 years. |

| Business Lines of Credit (LoCs) | Suitable for business owners with revolving capital needs. |

| Invoice Financing | Helpful for businesses with cash tied up in unpaid invoices. |

| Equipment Financing | Ideal for entrepreneurs needing capital to purchase equipment, costly tools, work vehicles or machinery. |

| Merchant Cash Advances | A reliable solution for business owners with a poor credit history who need fast access to capital. |

Why Choose Online Business Lenders Over Banks?

Internet loans have emerged as a recent financing option for businesses that previously struggled to secure traditional bank financing.

Following the financial crisis of the late 2000s, small businesses faced significant challenges in obtaining bank loans. Banks often required high annual revenues, strong credit scores, and an established relationship, leaving smaller businesses with lower earnings or shorter credit histories unable to access funding.

In response, online business lenders entered the market as an alternative solution. These lenders offer faster processes and less stringent requirements, aiming to facilitate small business financing. While some online lenders do establish minimum credit score criteria, they also consider other financial aspects such as annual revenue and credit card sales when evaluating loan applications.

According to the Federal Reserve Banks’ State of Small Business Credit Survey in 2020, 20% of surveyed firms sought financing from online lenders. Additionally, the survey highlighted that 35% of businesses with lower credit scores turned to these alternative online lenders for financial support.

Get a Small Business Loan Online

How Is an Online Business Loan Different from Traditional Loans?

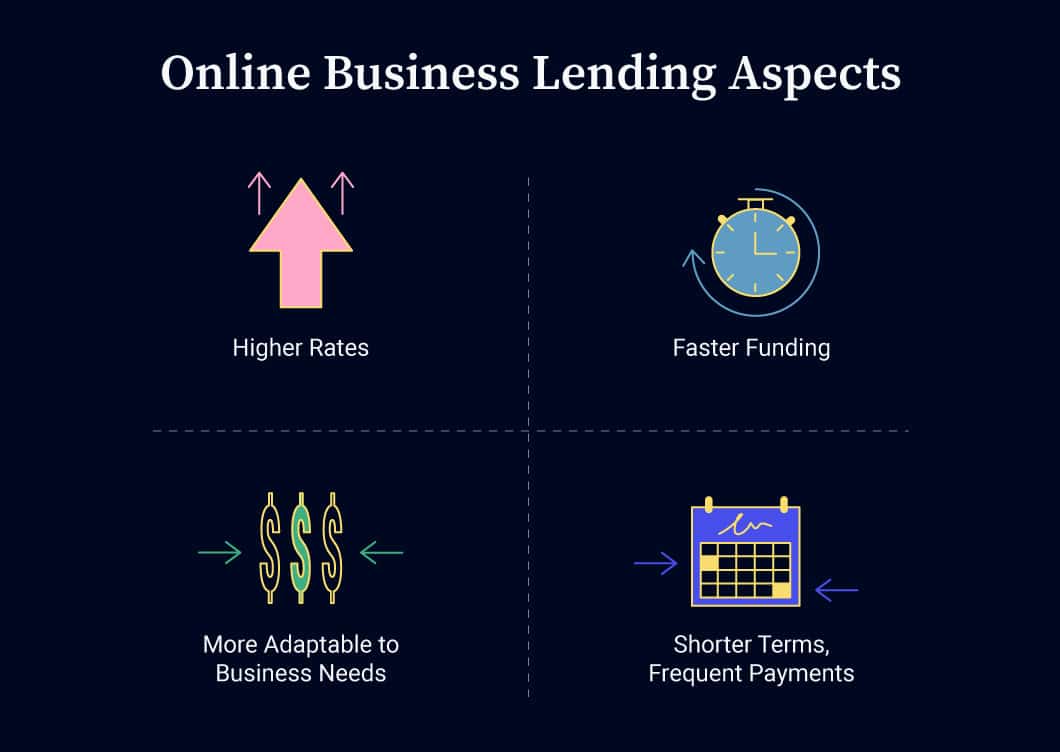

The speed, term lengths and adaptable nature of these loans can help you decide whether an online business loan is a right choice for your venture.

Higher Rates

Online business lenders serve a diverse range of business owners, from well-established enterprises to newcomers with limited credit histories. However, applicants with sparse credit histories or lower credit scores may pose higher risks to lenders, resulting in higher interest rates and annual percentage rates (APRs) for online small business loans.

When securing an online business loan, you’ll typically pay a premium for the convenience and flexibility it offers. Online loans often come with APRs exceeding 10%. In contrast, Small Business Administration (SBA) loans can feature lower interest rates starting from 6% to 7%. The higher rates associated with online business loans reflect the increased risk that lenders are willing to accept and the convenience they provide to borrowers.

More Adaptable to Your Needs

Internet loans provide considerable flexibility. Need to borrow a modest amount? Online lenders frequently offer loans as low as $10,000. Prefer a brief repayment period? Many online lenders accommodate small business loans with terms as short as 3 months.

Shorter Terms, More Frequent Payments

Online business lenders frequently collaborate with borrowers who may lack an extensive or robust credit history, which can increase lending risk. To mitigate this risk, these lenders often shorten loan terms to as little as 3 months and require weekly or even daily payments. This approach helps ensure that online business lenders can effectively recover their investment.

Faster Funding

When applying for a business loan at a bank, the process can be lengthy, often taking several weeks or even over a month for approval, involving substantial paperwork. In contrast, applying for a commercial loan online streamlines the process into a digital format that can be completed within minutes. Online lenders utilize proprietary algorithms to analyze your information thoroughly, enabling them to assess risk and make decisions swiftly.

Fast business loans obtained online allow you to access the necessary funds promptly. The entire process, from application to funding, can be completed in just a few days. Unlike the extended wait times often associated with traditional banks, internet loans offer businesses seeking immediate funding a remarkably quick turnaround.

Related: Bad Credit Business Loans? These Are Your 5 Best Options

Online Business Funding Options

Once you understand the criteria for securing approval for a commercial business loan, the next step is to find an online business loan that meets your specific needs. Whether you’re looking for an online small business loan despite having bad credit or seeking a long-term financing solution, we’ll explore some of the top options available.

Term Loan

If you’re embarking on a long-term project that requires capital financing, a term loan is an ideal choice.

iBusinessLender’s online business loan providers can offer term loans with the following features:

- Term lengths ranging from 1 to 5 years

- Interest rates starting from 7%

- Loan amounts up to $250,000

- Approval in as little as 1 day

Business Lines of Credit

If your business requires flexible access to capital, we recommend considering a business line of credit (LoC). With a LoC, you can borrow as needed up to a predetermined credit limit, which is advantageous for managing expenses like ongoing projects or renovations without overborrowing.

This type of financing allows you to pay interest only on the amount withdrawn, unlike a lump-sum term loan, potentially reducing your overall borrowing costs.

An online business line of credit is ideal for small business owners who require varying amounts of cash over time. If you anticipate needing $5,000 initially and possibly more later, applying for an online LoC could be the right choice.

iBusinessLender’s online business lenders offer terms such as:

- Term lengths from 6 months to 3 years

- Interest rates starting from 8%

- Credit limits up to $250,000

- Approval in as fast as 1 day

Merchant Cash Advance

Merchant cash advances are ideal for business owners facing a short-term cash crunch and seeking a quick, straightforward solution. Known for their rapid approvals and lenient credit score requirements, merchant cash advances offer a swift remedy if you need immediate funds or don’t meet the credit criteria for other online business funding options.

Once approved for a merchant cash advance, you’ll receive a lump sum of cash that you repay based on a percentage of your sales revenue, as determined by the lender. Payments are typically collected daily or weekly and calculated using factor rates. While the cost may seem higher initially due to these repayment terms, merchant cash advances can be highly beneficial for many small businesses.

Here are key features of online merchant cash advances available through our network of online business lenders:

- Repayment periods ranging from 3 to 24 months

- Factor rates starting at 1.10

- Advance amounts up to $500,000

- Same-day approvals

Related: Merchant Cash Advance vs. Business Loan: Which Is Best for You?

Accounts Receivable Financing

If you operate a company that issues invoices, particularly in sectors like professional services or business-to-business, and are seeking a commercial loan online, accounts receivable financing could be an excellent fit.

Accounts receivable financing allows businesses to leverage outstanding invoices as collateral for a cash advance. One of the advantages of invoice financing is that it doesn’t create additional debt. A cash advance is provided, typically 80% to 90% of the invoice value, minus a processing fee.

Although accounts receivable financing may not be the most cost-effective funding option for small businesses, it can be invaluable during cash flow challenges.

It’s important to note that factor fees, usually between 1.0 and 2.0, are often applied weekly until the invoices are fully paid.

Here are key invoice financing terms available through our network of online business lenders:

- Repayment occurs when invoices are settled by customers

- Cash advances up to 80% of receivables

- Same-day approvals

Equipment Financing

Equipment financing is designed specifically to fund the acquisition of equipment, ranging from X-ray machines to heavy construction tools. Most online equipment loans offer repayment terms spanning 1 to 5 years, and ownership of the equipment typically transfers to the borrower upon full loan repayment.

Beyond machinery and tools, online equipment financing can also be used to lease technology crucial for business operations. Industries such as construction, dental, and medical frequently utilize equipment financing to stay competitive by acquiring the latest technology.

Equipment financing terms vary, but when partnering with online lenders through the iBusinessLender marketplace, you can expect terms such as:

- Term lengths from 1 to 5 years

- Interest rates starting at 8%

- Financing up to 100% of the equipment value

- Approvals in as fast as 2 days

SBA Loan

The Small Business Administration (SBA) does not directly lend money to businesses. Instead, it acts as a guarantor that reduces the risk for lenders when extending capital to small business owners.

By guaranteeing up to 90% of the loan amount in certain cases, the SBA enables lenders to offer more favorable interest rates and larger loan amounts to businesses that may not qualify for traditional funding otherwise.

SBA loans are crucial for entrepreneurs and small businesses facing challenges in obtaining conventional financing.

However, acquiring an SBA loan can be slower compared to other types of online business loans.

Our network of SBA partner lenders offers terms including:

- Term lengths from 5 to 25 years

- Interest rates starting at 6.25%

- Loan amounts ranging from $5,000 to $5 million

- Approvals in as fast as 30 days

Short-Term Loan

A short-term loan is beneficial for small business owners needing immediate funds to cover expenses or bridge gaps during a cash flow crunch.

Typically, these loans come with repayment terms ranging from 3 to 18 months and higher interest rates, often 10% or more.

This type of online business loan is highly accessible, with approval possible in as little as a day due to lenient lender requirements.

Short-term online loans available through our network of lenders offer the following features:

- Term lengths from 3 to 18 months

- Interest rates starting at 10%

- Loan amounts ranging from $3,000 to $500,000

- Same-day approvals and funding

How to Get a Small Business Loan Online

The criteria some of the best online business lenders use to determine whether to approve financing include:

Time in Business

When applying for an online small business loan, applicants must provide essential information about their business to secure approval. One critical aspect is the duration of time your business has been operational. If your business is only a month old, your chances of securing a term loan or line of credit are minimal.

It’s advisable to establish your company and establish a market presence before seeking financing. Typically, after four months in business, your company may meet the minimum requirement for some online small business funding. After two years, you become eligible for approval from a wide range of online business lenders.

Business’s Annual Revenue

Annual revenue plays a crucial role in obtaining an online business loan. Lenders, whether online or traditional, often view applications as too risky unless the business has shown it can generate revenue and move towards profitability. Typically, a minimum annual revenue of $75,000 is required to qualify for many loans.

Credit Score

Traditional lenders typically require credit scores of 650 or higher. However, certain online business lenders may consider applicants with credit scores as low as 500. These lenders often provide options for those seeking online small business loans despite having bad credit. It’s important to note that lower credit scores generally lead to higher interest rates, shorter loan terms, and more frequent repayment schedules.

Compare Online Business Lenders

The Business Backer

This lender provides online small business loans and financing options, including accounts receivable financing and a business line of credit. The Business Backer reaches out to potential customers on the same day they submit their applications, with financing approvals possible within hours.

Here are the lender requirements for borrowers:

- At least 1 year in business for online business loans or accounts receivable financing; at least 6 months for a business line of credit

- Minimum annual revenue of $100,000 for online business loans and accounts receivable financing; $50,000 for a business line of credit

- Credit score of 550+ for a business loan or accounts receivable financing; 560+ for a business line of credit

The financing options from The Business Backer offer the following terms:

- Maximum funding amounts up to $200,000 for small business loans and accounts receivable financing; up to $100,000 for a business line of credit

- Factor rates starting at 1.2 for accounts receivable financing; interest rates starting at 1.7% for business loans and monthly rates starting at 3.3% for a business line of credit (additional fees may apply)

- Maximum repayment terms ranging from 18 to 24 months, depending on the financing type

Credibly

This lender offers online term loans and various financing options tailored to support established businesses. Applying with Credibly involves a prequalification process, with approval and funding possible within 24 hours.

Here are the general requirements for applying for a commercial loan online or other funding through Credibly:

- Minimum of 6 months in business

- Credit score of 500+

- $15,000 in monthly bank deposits or $50,000 in annual revenue (specific requirements vary by funding type)

Credibly’s online long-term business loans feature the following terms:

- Financing available up to $250,000

- Terms extending up to 2 years

- Interest rates starting from 9.99%

Smartbiz Loans

This online business lender provides commercial term loans and a range of business financing options, including facilitating the SBA loan application process. SmartBiz term loans can be utilized for various business needs such as working capital and equipment purchases. They also offer alternative financing solutions like invoice financing, business credit cards, and lines of credit. Approval and funding typically take up to a week after submitting your online application.

To qualify for SmartBiz Loans, potential borrowers generally need to meet the following criteria, which can vary depending on the specific loan:

- Minimum of 2 years in business

- U.S. citizenship or legal residency

- Minimum credit score of 640 (for SBA-backed loans) or 660 (for term loans)

- No bankruptcies or foreclosures in the last 3 years

Here are the terms for their online business loans:

- Interest rates starting at 4.75% for SBA loans and 6.99% for term loans and other financing options

- Maximum funding amounts up to $500,000 for term loans and other financing options; up to $5 million for SBA loans

- Terms ranging from 2 to 5 years for term loans, 24 to 60 months for other financing options, and 10 to 25 years for SBA loans

OnDeck

OnDeck offers swift access to online business loans with a streamlined process that spans just three steps, from application submission to approval notification for short-term loans or business lines of credit.

To qualify for their online small business funding, here are the general eligibility requirements:

- Minimum 1 year in business

- Annual revenue of at least $100,000

- FICO score of 600 or higher

Here are some of the key lending terms offered by OnDeck:

- Terms up to 24 months for short-term loans; 12-month terms for business lines of credit (which can be renewed)

- Maximum funding amounts up to $250,000 for term loans; up to $100,000 for business lines of credit

- Repayment schedules typically structured for daily or weekly payments

Everest Business Funding

The online lender offers merchant cash advances across diverse industries, including retail, healthcare, contracting, food service, seasonal businesses, and others.

Prospective borrowers can initiate the pre-approval process by providing essential personal and business details. Everest Business Financing prides itself on a high 95% approval rate for applications.

Here are the lender’s customer requirements:

- U.S.-based business

- Minimum monthly revenue of $4,000

Businesses can secure merchant cash advances ranging from $5,000 to $1 million, with funding available within 24 hours.

*Loan terms valid as of December 2021.

How to Apply for a Business Loan Online

Once you’ve determined the financing option that best suits your business needs and chosen the lenders you wish to work with, you’re prepared to apply for a commercial loan or other financing online.

Here are the essential business documents and information you’ll need to gather:

- Personal information for yourself and any other business owners or partners

- Incorporation documents for your business

- Doing-business-as (DBA) name, if applicable

- At least 6 months of bank statements

- Tax returns

- Investment information, if applicable

You’ll also be required to provide bank account routing information, though some lenders may allow direct connection to your account for funding purposes.

Once you have all the necessary details, you can initiate the application process by visiting the website of your chosen online business lender and using their web portal. The entire application process is conducted online, typically completed within minutes. Most online business loan providers take a few days, or even just a few hours, to review and approve applications. Certain lenders also offer same-day funding options.