Growing your business requires careful planning, strategic thinking, and sufficient resources, including capital. If you’re considering how to finance this growth, a secured business loan may be the answer.

Secured business loans are accessible to entrepreneurs running businesses of various sizes and types.

Is a secured loan suitable for your small business?

We’ll delve into everything you need to understand about secured small business loans and how they can benefit your company. We’ll discuss their mechanics, eligible collateral options, distinctions from unsecured loans, the various types available to small businesses, and the application process for securing this financing.

What Is a Secured Business Loan?

A secured business loan, also referred to as a collateralized loan, is a financing option that necessitates collateral to secure the funds. These loans can span both short- and long-term durations.

Typically, a conventional business loan is secured by collateral, which involves pledging assets as security.

How Do Secured Small Business Loans Work?

Secured business loans require borrowers to pledge assets, which the lender can seize in case of loan default. These loans may be secured against property or equipment, or insured with a specified amount of money. Once approved, the financing is disbursed as a lump sum, and the principal plus interest are typically repaid in monthly or weekly installments over an agreed-upon term.

Related: How to Get Startup Business Loans With No Collateral

What Can Be Used as Collateral for a Business Loan?

There are several types of collateral that can be used to secure your business loan. Lenders prioritize assets that are highly liquid or can be easily converted into cash if needed. Here are the most commonly accepted forms of collateral for a secured business loan:

Property

Many entrepreneurs secure business loans using property, such as real estate, as collateral. Real estate is valued highly and maintains its worth over time, allowing borrowers to access larger amounts of funding. However, it’s crucial to avoid overextending yourself, particularly if the property pledged as collateral is your primary residence. Defaulting on the loan could lead to the risk of losing your home.

Savings

You can also use a portion of your savings to secure a business loan. With a cash-secured loan, the bank holds those funds as collateral until the loan is fully repaid. Like using property as collateral, it’s important not to jeopardize your current or future financial security to secure a loan. However, applicants with substantial reserves can use their savings strategically to strengthen their businesses.

Equipment

Business equipment can serve as collateral for a secured small business loan. To secure a loan with this type of collateral, the equipment must be in good operational condition and have a reasonably high market value within your industry.

Self-Securing Loans

Another method of securing financing is through equipment financing. With this type of loan, the lender purchases and owns the asset at the beginning of the term and leases it to your business. It’s important to note that ownership of the equipment transfers to the borrower once the secured small business loan has been fully repaid.

Invoices

Invoicing your customers generates income for your business. Lenders view these outstanding invoices as valuable assets, considering factors such as the amount owed, the credibility of the company in debt, and the age of the invoices. This type of secured business loan is also referred to as accounts receivable (AR) financing or invoice financing.

Inventory

Just like using invoices or equipment to secure working capital, your business can leverage inventory (existing or future) as collateral. This allows you to obtain an advance on goods that are ready to be sold.

Secured vs. Unsecured Business Loans

Are all business loans secured? No. The key distinction between secured and unsecured loans lies in the requirement for collateral: secured business loans necessitate assets, whereas unsecured loans do not.

However, it’s important to note that most unsecured loans may still require a personal guarantee or a business lien to safeguard the lender from defaults.

Typically, secured business loans offer better interest rates compared to unsecured loans because they pose lower overall risk.

An essential difference between secured and unsecured loans is the priority in debt repayment if a borrower ceases operations and needs to liquidate assets. Lenders with secured agreements are prioritized for repayment, which may involve repossessing the collateral depending on the circumstances.

Is a Secured Small Business Loan Right for You?

If you have assets available to pledge as collateral for securing business funding and you’re comfortable with doing so, then the answer is yes.

If not, an unsecured loan may be a more suitable option. If you’re unsure whether to choose a secured or unsecured loan for your business, consider the following factors:

- Do you own assets that can be used as collateral?

- How much funding do you require?

- What is your credit score?

These three factors will significantly influence your decision on the appropriate loan type and your likelihood of qualifying for it. It’s worth noting that securing a business loan with collateral is feasible even with a lower credit score, provided the borrower has sufficient assets to secure the funding.

Let’s examine each of these considerations in detail:

Owning Your Assets

If you do not own your assets outright, you cannot use them as collateral. For example, even if you have paid 97% of the cost through a lease-to-own agreement for an asset, you cannot pledge that specific item as collateral until you legally own it.

Desired Funding Amount

For businesses seeking loans exceeding $25,000, lenders generally require collateral to secure the funds. While it is possible to obtain unsecured business loans for larger amounts, they often come at a higher cost to the borrower, including higher interest rates.

Credit Score

Your credit score demonstrates to lenders your ability to manage finances and repay debts. When securing a business loan, a higher credit score typically reduces collateral requirements for secured loans and improves your loan terms. However, even with a lower credit score, valuable collateral can mitigate risk and increase your chances of loan approval.

How Much Can My Business Qualify For?

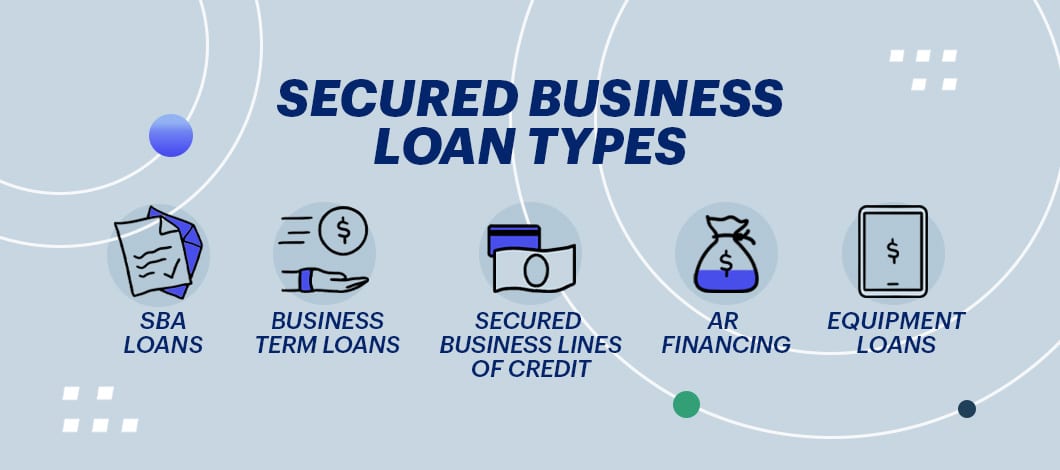

Best Secured Business Loans

Deciding whether your business is better suited for a secured or unsecured business loan also depends on the type of loan you need.

Each lender will have its own set of standards and preferences.

Equipment Loans

Equipment loans enable businesses to purchase equipment that may otherwise be financially challenging. Typically, the equipment itself serves as collateral for the loan. This means that if your business fails to make payments, the lender can reclaim the equipment to recoup their costs.

With equipment financing, your business repays the loan with an interest rate agreed upon by the lender, leveraging the purchased equipment as collateral. Qualifying for equipment financing is generally straightforward, contingent on the equipment’s cost and the lender’s criteria.

SBA Loans

SBA loans are partially guaranteed by the Small Business Administration (SBA). This guarantee ensures that the SBA will reimburse a portion of the lender’s losses if your business defaults on the loan. Due to this assurance, SBA loans typically offer lower interest rates and longer repayment terms compared to other small business financing options. Depending on the loan amount, lenders may still require collateral. For instance, collateral is not typically required for SBA loans up to $25,000.

Secured Business Lines of Credit

A business line of credit offers flexible access to funds that your company can utilize as needed. You withdraw only the amount required, up to the approved credit limit, and pay interest solely on the borrowed amount. There is no obligation to utilize the entire credit line.

The advantages of a business line of credit make it a favored choice among business owners. It provides the flexibility to access revolving funds according to your business’s needs, thereby enhancing cash flow management.

Related: Your Ultimate Guide to Unsecured Business Lines of Credit

Accounts Receivable Financing

If your business manages multiple accounts with payments due, this is the type of financing for you. Lenders provide your business with access to the cash it’s owed.

Accounts receivable (AR) financing is another type of secured business loan. The invoices serve as the security for the financing.

Business Term Loans

A business term loan provides a lump sum of capital that you repay over a specified period. These loans are typically used for substantial, long-term investments such as purchasing equipment, refinancing debt, or acquiring commercial real estate.

Term loans offer businesses advantages like higher borrowing limits, extended repayment schedules, and lower interest rates. However, to access these favorable terms, stricter qualifying criteria must typically be met.

-

Is a Secured Business Loan Easier to Get?

Qualifying for a secured small business loan is often easier for borrowers because the collateral reduces the lender’s risk and instills confidence in approving your application. This added layer of security is particularly beneficial if you have a limited credit history or a weaker credit score, as these factors might otherwise concern lenders.

How to Get a Secured Business Loan

When preparing to apply for a secured business loan, you’ll need to gather pertinent documents and business details to provide lenders with a comprehensive view of your business and any pledged assets.

This typically includes:

- Basic business information, including articles of incorporation if applicable

- Information about yourself, business partners, or other owners

- Doing-Business-As (DBA) name

- Recent bank statements

- Voided business check

- Tax returns

- Stock ownership documents or certificates

- Proof of assets

Your lender will assess the value of your collateral and determine the financing amount based on the assessed value of the assets. Note that secured business loan requirements can vary depending on the type of financing and the specific lender.

Which Institutions Are the Best Secured Loan Lenders?

There’s no one-size-fits-all answer. Conventional lenders like banks and credit unions offer larger loan amounts, potentially lower interest rates, and longer repayment terms. However, they typically have stricter requirements for secured business loans, such as a good to excellent credit score (670 or higher) and a lengthy credit history. Having an established relationship with the bank can also improve your chances of approval.

If you need quick access to secured business loans, traditional lenders like banks and credit unions often require extensive paperwork and may take longer to process applications. Some may even necessitate in-person meetings for parts of the application process. Moreover, securing a business loan involves appraising pledged assets, which can further delay the approval process.

In contrast, alternative or online lenders may consider businesses with shorter operating histories (1 or 2 years) and those still building their credit profiles. However, because these borrowers are perceived as higher risk, they may qualify for loans with higher interest rates, more frequent payments, or shorter terms.

For those seeking expedited funding, applying through an online lender, such as iBusinessLender, could be advantageous. Online lenders typically offer a streamlined application process that can be completed entirely online within minutes.