All types of business financing come with rates and fees that contribute to the overall cost of borrowing or advancing funds. While traditional loans usually carry interest rates that represent a percentage of the borrowed amount, some short-term business financing products use factor rates instead.

Let’s explore what a factor rate is, how to calculate it, and what it means for your business financing.

Understanding Factor Rates

A factor rate is expressed as a decimal figure, typically ranging from 1.1 to 1.9, with the average falling between 1.5 and 1.9. This rate is commonly used in short-term business financing products, such as accounts receivable financing and merchant cash advances. These types of financing are highly approved, boasting an 84% approval rate according to the Federal Reserve Banks’ Small Business Credit Survey.

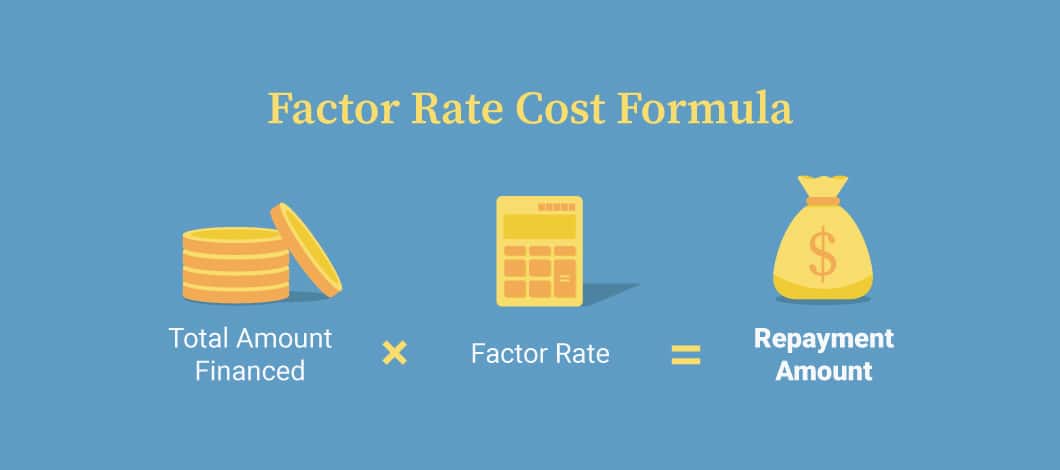

Lenders determine the factor rate based on several criteria, including your creditworthiness and the length of time your business has been operating. Once established, the factor rate is multiplied by the total amount financed to calculate the overall cost of borrowing. Similar to an interest rate, a lower factor rate indicates more affordable financing.

However, unlike an interest rate, which may compound and vary over the loan term, a factor rate is calculated once at the beginning of the financing period and remains fixed throughout. This means that the total repayment amount is set from the start, providing clear and predictable repayment terms.

Understanding factor rates and how they work can help you make more informed decisions when considering short-term financing options for your business. By comparing different factor rates and the terms offered by various lenders, you can secure the best possible deal to support your business needs.

Related: So, How Much Is a Small Business Loan? (Rates, Fees and Other Costs)

Calculating Factor Rate Costs

If you’re wondering how to calculate a factor rate, here’s the loan factor formula:

For instance, suppose you’re seeking merchant cash advance financing amounting to $20,000. The lender offers you a merchant cash advance factor rate of 1.2.

To determine your total repayment amount, simply multiply your financing amount ($20,000) by the factor rate (1.2):

$20,000 X 1.2 = $24,000

The difference between your advance amount and the total repayment amount ($24,000 – $20,000 = $4,000) represents the cost to borrow the funds. In this scenario, to secure a $20,000 advance, you’ll pay $4,000 in fees.

In reverse calculation, you can find the factor rate from the total repayment amount by dividing it by the financed amount:

Using our example, divide $24,000 by $20,000 to find the factor rate:

$24,000 / $20,000 = 1.2

Note: Funding fees are common in factor rate financing and are distinct from the factor fee itself.

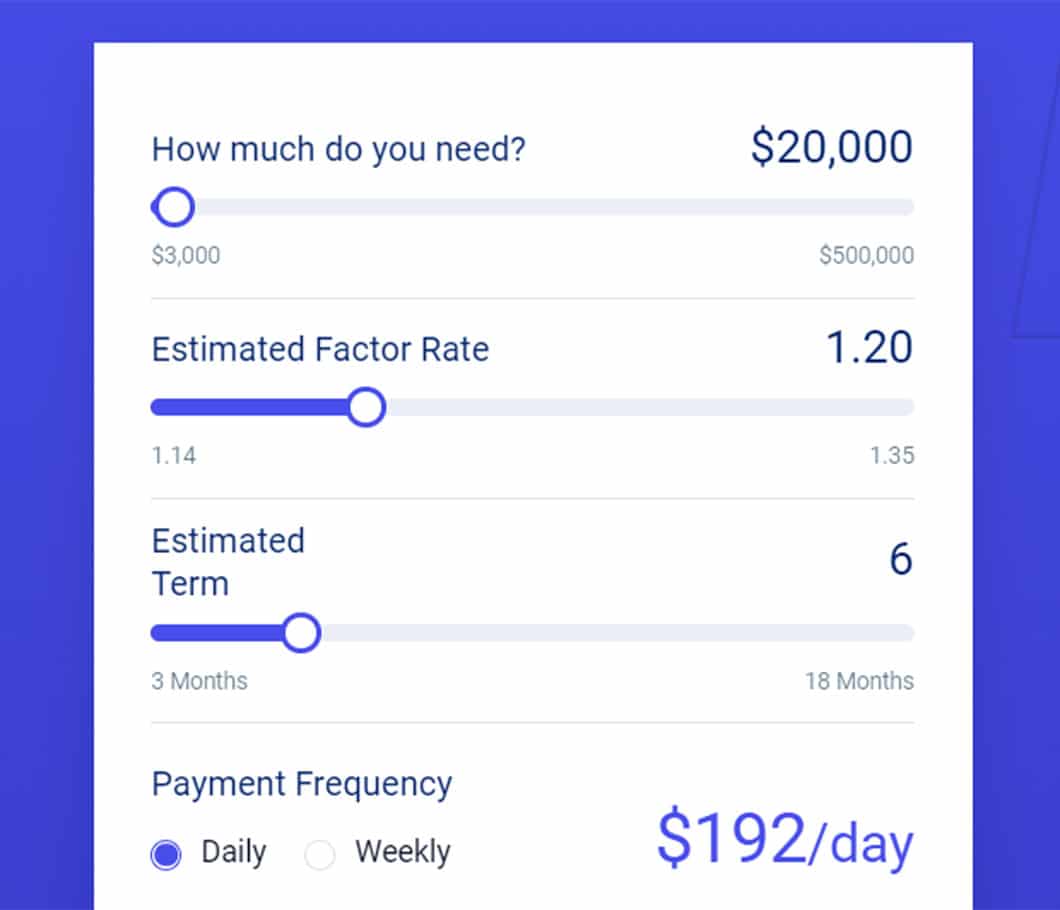

Using a Factor Rate Calculator to Determine Payment Installments

You can use interest rate and factor rate calculators to determine your financing costs.

Online calculators are particularly helpful in computing your factor rate payments, whether you have a daily or weekly repayment schedule.

To estimate your payment schedule using a factor rate calculator, you will need to input the following details:

- Financing amount

- Factor rate

- Repayment term

- Payment frequency

For example, using an online merchant cash advance calculator to determine the cost of financing $20,000 at a 1.2 MCA factor rate over a 6-month term would yield approximately $190 per day. Alternatively, if the repayments were structured weekly, the same financing setup would result in payments of about $960 per week.

By using these online tools, you can better understand the total cost of your financing and plan your repayment schedule accordingly. This ensures that you make informed decisions that align with your business’s cash flow and financial needs.

Factor Rate vs. Interest Rate: What’s the Difference?

One of the key distinctions between a factor rate and an interest rate is how they impact payment calculations and the overall repayment amount.

For traditional loans that charge interest, the total interest cost can decrease with early repayment, as interest accrues over time based on the outstanding balance. This means that paying off the loan early can result in savings on interest costs.

In contrast, with factor rates, the total repayment amount is fixed at the outset of the loan. The factor rate is applied once when the loan is initiated, and this determines the total amount you owe. Whether you repay early or on schedule, you are still responsible for the total amount financed plus the fees calculated by the factor rate. Early repayment does not reduce the overall cost.

Interest rates on loans adjust based on the outstanding balance and payment history throughout the loan term. Therefore, if you pay off a loan with an interest rate ahead of schedule, you generally save on total interest costs over the life of the loan. This key difference makes understanding both types of rates essential when choosing the right financing option for your business.

Interest Rate vs. Annual Percentage Rate

It’s important to understand that an interest rate and an annual percentage rate (APR) are not the same. The interest rate refers specifically to the cost of borrowing the principal amount of your loan, and it is this rate that determines your monthly installment payments.

In contrast, the APR takes into account not only the interest rate but also additional costs and fees charged by the lender, such as origination fees. Therefore, the APR gives a more comprehensive view of the total annual cost of securing a business loan. By considering both the interest rate and these additional expenses, the APR provides a clearer picture of the overall cost of borrowing.

Converting Factor Rates to Annualized Interest Rates

Factor rate financing typically does not extend beyond a year, so calculating an annualized rate isn’t a direct comparison. However, if you want to estimate what your factor rate would equate to in terms of annual interest, follow these steps:

Using our previous example of a $20,000 merchant cash advance at a 1.2 factor rate, the total repayment is $24,000, including $4,000 in financing fees.

Calculate the financing cost percentage by dividing the financing fees ($4,000) by the original advance amount ($20,000):

$4,000 ÷ $20,000 = 0.20 or 20%

Next, multiply this percentage (20%) by the total number of days in a year, 365:

0.20 × 365 = 73

Finally, divide this number by the total repayment period. Assuming the merchant cash advance is due in 6 months (180 days):

73 ÷ 180 = 0.405 or 40.5%

Therefore, the estimated annualized interest rate for this example of factor rate financing would be approximately 40.5%.

What Influences Your Factor Rate?

Your factor rate can vary based on the overall health of your business and its credit history.

Securing business financing involves several complexities, and lenders aim to minimize their risks. They thoroughly assess your business model, focusing on your cash flow history and your ability to meet financial obligations promptly.

During the application process, you will likely need to provide additional documentation that demonstrates your business’s performance. Based on these insights, lenders may adjust their rates, offering higher or lower rates depending on their assessment.

Several key factors can influence your factor rate:

- Bank Statements: Recent statements, typically from the last four months or more, show your cash flow.

- Credit Card Processing Statements: These documents indicate your sales and revenue streams.

- Time in Business: Businesses that have been operating for longer periods are often viewed as more creditworthy.

- Business Tax Returns: Consistent income reports can strengthen your application.

Different lenders use distinct evaluation methods, so factor rates can vary. Once you receive a factor rate, it’s important to compare the total borrowing costs with other offers to ensure you are getting the best deal possible. This comparison helps you understand the true cost of financing and make an informed decision for your business.

Why Choose Factor Rate Financing?

Factor rate financing is often attractive to business owners with low credit scores seeking rapid access to cash. Online lenders frequently facilitate same-day funding upon application.

Typically, there are no restrictions on the use of these funds. Factor rate financing may be suitable for:

- Payroll

- Rent

- Utilities

- Taxes

- Emergencies

- Repairs

- Equipment purchases

- Working capital

How to Find the Right Factor Rate Financing

Choosing the right factor rate financing for your business involves considering several key aspects. Evaluate repayment terms, borrowing conditions, and the impact on your personal credit as you assess your options.

Calculating your borrowing costs upfront allows you to gauge the affordability of your loan, compare different offers, and plan your finances effectively. When exploring business financing options, you’ll likely encounter multiple offers with varying factor rates.

It’s crucial to conduct thorough research on business lending. Seek information, advice, and practical assistance to seamlessly integrate borrowing into your business strategy. Ask questions, request detailed pricing information, and inquire about any special offers and terms when obtaining factor rate quotes. This approach ensures that you make informed decisions that align with your business’s financial goals.

By doing so, you can select the financing option that best supports your business needs and long-term objectives.