Solve Funding Emergencies With a Business Line of Credit

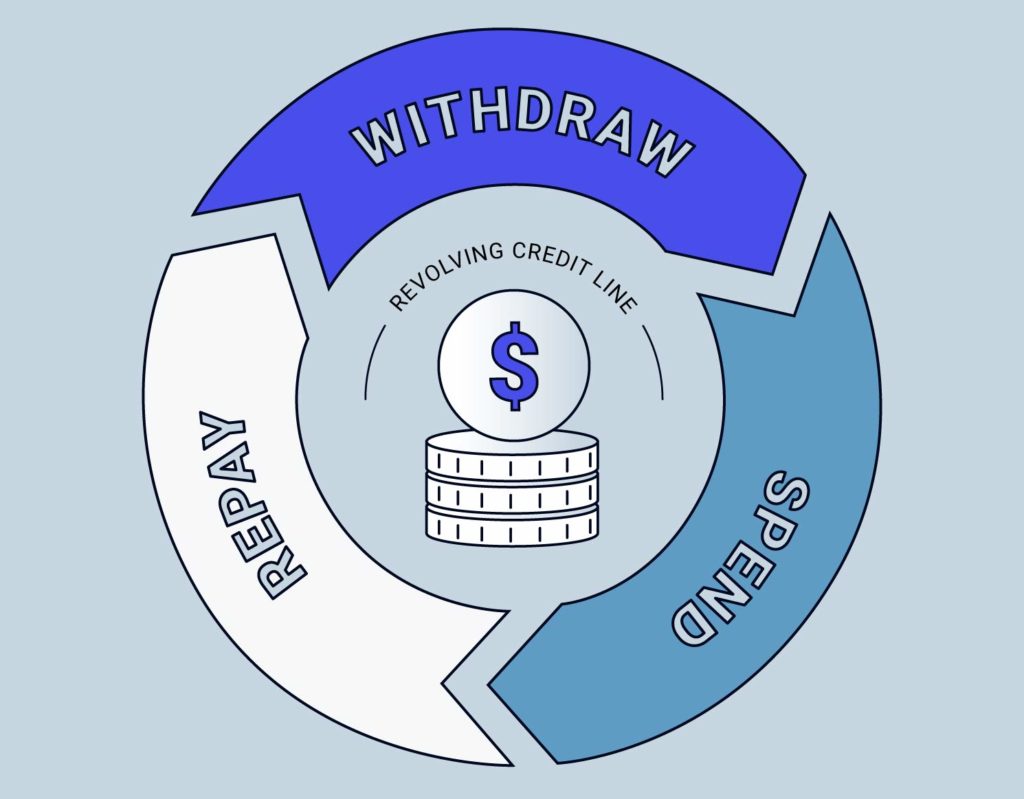

A business line of credit provides the flexibility to access funds whenever needed without the hassle of reapplying each time. You can spend, repay, and reuse the funds as often as necessary throughout the term of the credit line, making it a convenient and adaptable financing solution for your business.

At iBusinessLender, we partner with a diverse range of lending institutions that offer small business lines of credit. This collaboration allows you to compare multiple offers and select the one that best meets your specific business needs.

Our online business lines of credit enable you to quickly address emergencies or capitalize on new opportunities. This financial tool offers the peace of mind and security necessary to manage your business effectively, ensuring that you have the resources at hand to handle unexpected expenses or invest in growth initiatives. Whether you need to cover short-term cash flow gaps, purchase inventory, or fund immediate projects, a business line of credit from iBusinessLender provides the flexibility and support your business needs to thrive.

Contents

SECTION 1

Understanding Business Line of Credit

Flexible “On-Demand” Financing with a Business Line of Credit

A business line of credit is an “on-demand” financing option that gives borrowers access to a maximum approved credit limit, from which they can draw funds as needed. Whether you need to withdraw a partial amount or the full limit, you only accrue interest on the amount you actually use. This makes it an adaptable and cost-effective solution for managing your business’s financial needs.

Why Entrepreneurs Prefer Business Lines of Credit

This financing option is particularly popular among entrepreneurs due to its flexibility and convenience. According to the Federal Reserve Banks’ State of Small Business Credit report, 35% of surveyed employer firms applied for a business line of credit. Of those applicants, a substantial 71% received approval, highlighting the accessibility and appeal of this financing method.

Advantages of a Business Line of Credit

- Flexibility: Access funds whenever needed without reapplying, and repay as you go, similar to a credit card but often with more favorable terms.

- Cost Efficiency: Pay interest only on the amount you draw, not on the entire credit limit.

- Versatility: Use the funds for a variety of purposes, such as managing cash flow, purchasing inventory, or handling unexpected expenses.

- Revolving Credit: As you repay the borrowed amount, the available credit replenishes, making it a sustainable long-term financing tool.

iBusinessLender’s Business Lines of Credit

At iBusinessLender, we work with a network of trusted lending partners to offer you tailored business lines of credit. By comparing multiple offers, you can find the best terms and conditions that suit your business needs.

Our streamlined online application process ensures you can quickly secure the funds you need to address emergencies or seize new business opportunities. With a business line of credit from iBusinessLender, you gain the financial flexibility and peace of mind necessary to manage and grow your business effectively. Whether it’s bridging cash flow gaps, funding operational costs, or investing in growth, a business line of credit is a valuable tool for sustaining and expanding your enterprise.

How Does a Business Line of Credit Work?

Once approved for a business line of credit, you gain the flexibility to access funds whenever you need them, up to your approved limit. At iBusinessLender, our lending partners offer revolving credit lines. This means that as you repay the borrowed amounts, your available credit is replenished up to your original limit.

Depending on the lender, you may encounter a small draw fee for each withdrawal, and there might be minimum withdrawal amounts. Additionally, if your credit line remains unused for a certain period, you may incur an inactivity or maintenance fee.

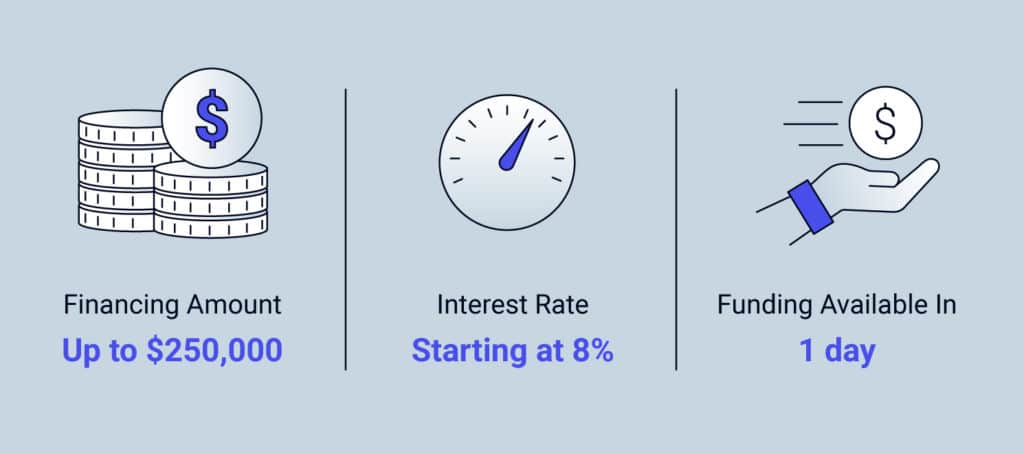

Terms and Rates

At iBusinessLender, the terms for business lines of credit range from 6 months to 2 years. Approval amounts can reach up to $250,000, with rates starting as low as 8% for small business lines of credit. Once approved, you could gain access to your credit line within a day, allowing for rapid financial flexibility.

Secured vs. Unsecured Lines of Credit

Business lines of credit can be either secured or unsecured. At iBusinessLender, we specialize in offering unsecured credit lines. Here’s a breakdown of each type:

Secured Business Lines of Credit

Secured business lines of credit require collateral to support the credit line. Collateral includes assets that the lender can seize and sell to recover any outstanding balance in case of default. Common types of collateral include:

- Real estate

- Personal or company vehicles

- Home equity

- Inventory

- Equipment

- Accounts receivable (such as unpaid invoices)

Because collateral reduces the lender’s risk, secured credit lines often feature more competitive interest rates, higher approval amounts, and more favorable terms compared to unsecured credit lines.

Unsecured Business Lines of Credit

Unsecured business lines of credit do not require specific collateral. This means that in the event of default, the lender does not have pledged assets to claim for loss recovery. However, to mitigate their risk, lenders offering unsecured lines of credit employ other measures, such as:

- Lower credit limits

- Higher interest rates

- Shorter terms

- Requirement of a personal guarantee

Applications for unsecured credit lines are typically more straightforward and can be processed quickly. Applicants often receive decisions within hours, especially when applying for an instant business line of credit. Additionally, funds can become available within a day of approval, providing quick access to necessary capital.

Advantages of a Business Line of Credit

- Flexibility: Withdraw funds as needed up to your credit limit without reapplying.

- Revolving Credit: Replenish your credit line as you repay, ensuring continuous access to funds.

- Cost-Effective: Pay interest only on the amount you use, not on the entire credit limit.

- Rapid Access: Quickly address emergencies or seize new opportunities with fast approval and funding.

By understanding the distinctions and benefits of secured and unsecured business lines of credit, you can choose the option that best fits your financial needs and business strategy. At iBusinessLender, our streamlined application process and diverse lending partners ensure you find the right credit solution to support your business growth and operational stability.

SECTION 2

When is a Business Line of Credit the Right Choice?

What They’re Best Used For

Business lines of credit are ideal for addressing short-term financial needs and unexpected expenses. They offer a range of benefits and some potential drawbacks that business owners should consider.

Pros

- Flexible Use of Funds: Business lines of credit provide the freedom to use the borrowed money for any business-related expenses, without restrictions.

- Revolving Credit: As you repay the borrowed amount, the funds become available again, allowing for continuous access to capital as needed.

- No Collateral Required: Many business lines of credit do not require collateral, reducing the risk for the borrower.

- Interest Only on Drawn Funds: You only pay interest on the amount you actually use, not on the entire credit limit.

- Quick Access to Capital: Business lines of credit can be used immediately for various needs such as managing cash flow, purchasing inventory, or covering unexpected costs.

Cons

- Draw and Inactivity Fees: Some lenders may charge fees for withdrawing funds or for periods when the credit line is not in use.

- Minimum Withdrawal Amounts: There may be minimum amounts that you are required to withdraw, which could limit flexibility.

- Lower Limits Compared to Installment Loans: The credit limits on business lines of credit are often lower than those of installment loans, which might restrict the total amount of available funding.

- Potential for Misuse: The easy access to funds can lead to poor financial management if not used responsibly, potentially putting the business at financial risk.

SECTION 3

What Does a Business Line of Credit Cost?

Factors Influencing Your Business Line of Credit Costs

The interest rate and overall costs associated with your business line of credit depend on various factors related to your business’s financial health and history. Key factors include:

- Credit History: A strong credit history can help secure lower interest rates.

- Revenue: Higher revenue levels typically make a business more attractive to lenders.

- Cash Flow: Consistent positive cash flow can improve your borrowing terms.

- Time in Business: Established businesses with a longer operational history are generally seen as lower risk.

- Industry: Certain industries may be viewed as riskier than others, impacting interest rates and fees.

How Interest Accumulates on a Business Line of Credit

With a business line of credit, you only pay interest on the funds you actually draw, not on the entire credit limit. When you draw funds, your outstanding balance is re-amortized, meaning the interest is calculated based on the amount you’ve borrowed. This makes it a cost-effective way to access capital as needed.

Common Business Line of Credit Fees

In addition to a potential one-time origination fee incurred upon approval, there are other common fees associated with business lines of credit:

- Draw Fees: Typically range from 1% to 3% of the amount drawn.

- Maintenance Fees: Some lenders charge a fee for maintaining the credit line, regardless of usage.

- Inactivity Fees: If you do not draw from the credit line for a certain period, an inactivity fee may apply.

Business Line of Credit Example

Imagine you have been approved for a $10,000 business line of credit. You are not required to use the full amount immediately. Suppose you need $1,000 to purchase inventory this month. You can draw $1,000 from your $10,000 credit line.

You will incur a draw fee on the $1,000 borrowed, and interest will be charged only on that $1,000. Your available credit limit will then be $9,000 until you repay the $1,000, at which point your full $10,000 limit will be restored. Meanwhile, you can still access the remaining $9,000 for other business needs.

This flexible structure allows you to manage your business’s finances efficiently, drawing funds as needed and paying interest only on what you use. This makes a business line of credit a versatile and cost-effective financing tool for managing cash flow, covering unexpected expenses, or seizing new business opportunities.

SECTION 4

How to Qualify for a Business Line of Credit

Qualifying for a Business Line of Credit

The more established your business and the stronger your credit score, the easier it will be to qualify for a business line of credit and to secure better terms. Businesses with solid operational histories and strong financial profiles are more likely to receive favorable interest rates and higher credit limits.

What Our Lenders Evaluate

When assessing applications for a line of credit, lenders consider several key factors to determine your business’s financial health and eligibility:

- Recent Bank Statements: These help lenders understand your cash flow, current expenses, debt commitments, and income.

- Time in Operation: How long your business has been running can influence approval chances.

- Annual Revenue: Higher revenue levels can make your business more attractive to lenders.

- Personal Credit Score: Your personal credit score plays a significant role in the approval process.

Eligibility Criteria for Online Business Lines of Credit

To be eligible for an online business line of credit, you must meet specific criteria related to your business’s operational history, annual revenue, and your personal credit score. For example:

- Newer Businesses or Those with Poor Credit: May qualify for short-term business lines of credit with lower approval amounts and higher interest rates.

- Established Businesses with Strong Financials: Are more likely to qualify for long-term lines of credit, offering higher limits and more competitive rates.

iBusinessLender Minimum Qualifications

At iBusinessLender, we work with lending partners who are willing to consider applicants with the following minimum qualifications:

- Credit Score: 560 or better

- Time in Business: At least 1 year

- Annual Revenue: $200,000 or more

These criteria ensure that even businesses with less-than-perfect credit can still access the necessary funds to support their operations and growth.

Improving Your Chances of Approval

To improve your chances of qualifying for a business line of credit with favorable terms, focus on:

- Building a Strong Credit History: Regularly monitor and improve your credit score by paying bills on time and reducing debt.

- Maintaining Consistent Cash Flow: Ensure your business demonstrates healthy and consistent cash flow through accurate financial management.

- Increasing Revenue: Aim to grow your annual revenue, as higher earnings can make your business more appealing to lenders.

- Extending Your Operational History: The longer your business has been operational, the more trustworthy it appears to lenders.

By meeting these criteria and focusing on these strategies, you can better position your business to secure the funding it needs. At iBusinessLender, our goal is to connect you with lending partners who offer flexible and accessible financing options tailored to your business’s unique needs.

SECTION 5

Business Lines of Credit Through iBusinessLender

What Sets Us Apart

Small businesses have placed their financing needs in our hands, and our ratings reflect their satisfaction.

With just one application, explore offers from top business lines of credit lenders.

Applying is quick, straightforward—and crucially—preapprovals are accessible without affecting your credit.

How to Apply for a Business Line of Credit

Apply for a business line of credit online in a few simple steps:

- Tell us about yourself and your business

- Attach recent bank statements

- Get multiple loan offers

Once you pick the offer that works for you, your small business line of credit could be funded within a day of approval.

SECTION 6

Business Line of Credit: Frequently Asked Questions

Funds from a business line of credit provided by iBusinessLender’s network of financial partners can be utilized for any legitimate business need. Here are some of the most common ways entrepreneurs and business owners use these funds:

- Payroll: Ensuring employees are paid on time, even during cash flow fluctuations.

- Supplies: Purchasing necessary office or operational supplies to keep the business running smoothly.

- Bill Payments: Managing recurring expenses such as rent, utilities, and other essential bills.

- Inventory Purchases: Stocking up on inventory to meet customer demand without cash flow interruptions.

- Emergency Expenses: Covering unexpected costs that arise from unforeseen circumstances, ensuring business continuity.

With flexible access to funds, businesses can maintain stability and seize growth opportunities as they arise.

While a small business line of credit and a business credit card may appear similar, they have distinct differences that set them apart:

Access to Working Capital

A business line of credit typically provides higher borrowing limits compared to a business credit card. Additionally, although you can obtain a cash advance from a business credit card, this option often comes with higher interest rates and additional cash advance fees, making it a more expensive choice.

Repayment Schedules

Business lines of credit offer substantial flexibility but have structured repayment terms. Each withdrawal from the line of credit has a set repayment period, with weekly or monthly installments that may extend over several months or years, depending on the terms agreed upon.

Conversely, business credit cards offer more freedom in repayment schedules. There is no fixed repayment term, allowing business owners to pay off their balance at their own pace, as long as they meet the minimum monthly payment.

Fees and Rewards

Business credit cards often come with attractive rewards programs, offering points, cashback, or other incentives for purchases. However, these perks usually come with an annual fee, which compensates the card issuer for the benefits provided. On the other hand, business lines of credit typically do not offer rewards programs but may have lower overall fees compared to credit cards.

In summary, while both financial products can be useful for managing business expenses, understanding their differences can help you choose the one that best suits your needs.

When comparing term loans and lines of credit, several key differences stand out:

Loan Terms and Fund Availability

With a term loan, you are approved for a specific loan amount, which is disbursed to you in a single lump sum. Interest on this amount starts accruing immediately, and the funds do not replenish once they are used. In contrast, a business line of credit provides a revolving credit limit that you can draw from as needed. Interest only accrues on the amount you actually use, and the available credit replenishes as you repay what you’ve borrowed.

Payment Schedules

Term loans require you to start making fixed payments right away, according to a predetermined schedule. These payments typically include both principal and interest. On the other hand, with a business line of credit, you only make payments when you draw from the credit line. This can provide more flexibility in managing your cash flow, as you only pay interest on the amount you use.

Repayment Periods

Term loans generally come with longer repayment periods, ranging from one year up to 25 years. This allows for more extended planning and budgeting but also means a longer commitment. Business lines of credit usually have shorter repayment terms, which can range from a few months to several years, depending on the agreement. This shorter duration can be beneficial for managing short-term funding needs without a long-term obligation.

Key Considerations

- Term Loans: Best suited for large, one-time investments or purchases, such as equipment, real estate, or significant expansions. They provide a predictable repayment structure, which can be advantageous for long-term financial planning.

- Lines of Credit: Ideal for managing ongoing operational expenses, unexpected costs, or fluctuating cash flow needs. The flexibility to draw and repay as needed makes it a versatile tool for short-term financial management.

Understanding these differences can help business owners choose the right financial product for their specific needs, ensuring they have the appropriate support for their financial strategies and goals.