Move at the Speed of Business

In the competition between merchant cash advances (MCAs) and traditional business loans, MCAs consistently surge ahead, arriving at the finish line well before their counterparts. The speed at which business capital can be accessed with an MCA is remarkable.

Moreover, factors like your credit score and the length of time your business has been operating won’t stand in your way. With the support of iBusinessLender, businesses that have been running for just four months and have a credit score as low as 500 can still secure the funding they need.

Even better, same-day funding for merchant cash advances is attainable. This means you can quickly capitalize on new opportunities or ensure smooth operations by rapidly obtaining the necessary funds.

Contents

SECTION 1

Understanding a Merchant Cash Advance

A merchant cash advance (MCA) serves as an alternative financing option to traditional loans, offering businesses a lump sum of capital based on their projected future sales. These advances are typically short-term and are repaid through manageable daily or weekly payments until the total amount, including any lender fees, is fully paid off. MCAs are widely accessible to a large number of small business owners.

How Does a Merchant Cash Advance Work?

At iBusinessLender, we partner with lenders who specialize in Automated Clearing House (ACH) merchant cash advances, a form of revenue-based financing (RBF). These ACH MCAs calculate approval amounts based on a business’s expected revenue, ensuring that the advance aligns with the business’s financial capacity. This provides access to an upfront sum of working capital in exchange for a portion of the business’s future revenue.

Payments will be a set percentage of revenue and if the business generates less, their payment is eligible to decrease proportionally. These payments are conveniently and automatically deducted from your linked business bank account, making the repayment process seamless and hassle-free.

SECTION 2

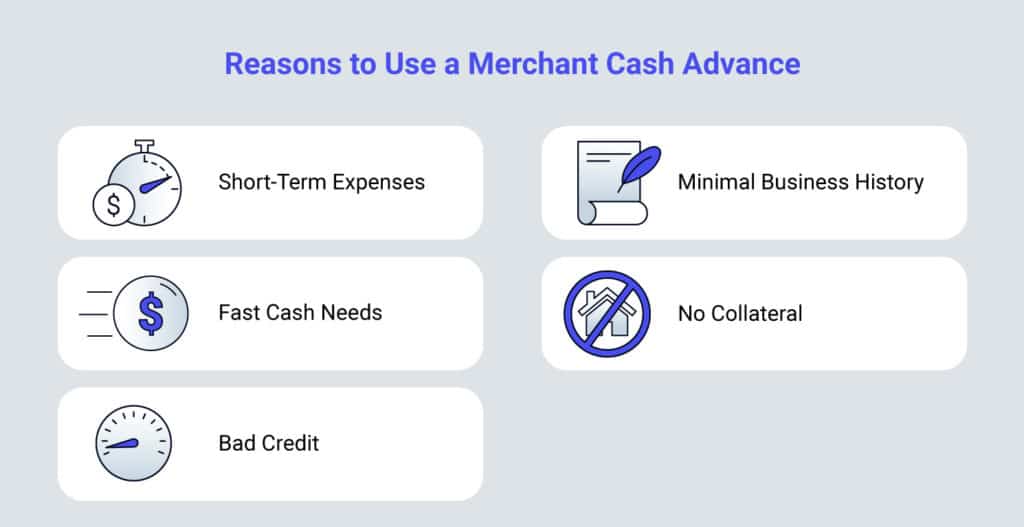

When Is a Merchant Cash Advance the Right Choice?

In the dynamic landscape of business, cash flow shortages are a common challenge, and unexpected expenses or opportunities can emerge at any moment. Unfortunately, traditional financing options are not always feasible, often due to delays, credit score requirements, or the length of time the business has been operational. Here are several compelling reasons to consider applying for a merchant cash advance (MCA).

Short-Term Expenses

Merchant cash advances (MCAs) are particularly well-suited for addressing short-term capital needs and funding ventures that can quickly generate profits. A smart use of an MCA might involve purchasing inventory that can be swiftly sold at a profit. Businesses that effectively leverage MCAs have a deep understanding of the associated costs and how they compare to the potential return on investment.

Fast Cash Needs

Merchant cash advances are among the fastest financing options available. Some MCA lenders can disburse funds on the same day the application is approved, providing quick access to the capital you need.

Bad Credit

MCA providers often work with business owners who have lower credit scores, unlike traditional lenders. If your credit score is around 500 or higher, you might still qualify for a merchant cash advance. The key factor is having sufficient cash flow to support repayment, making MCAs a viable option even for those with less-than-perfect credit.

Minimal Business History

iBusinessLender’s merchant cash advances are accessible to businesses with just four months of operation, making them an attractive option for new and growing enterprises. Additionally, businesses with longer operational histories may qualify for better terms and rates, further enhancing the appeal of MCAs.

No Collateral

Unlike many traditional loans, merchant cash advances do not require specific collateral, making them a form of unsecured financing. While a personal guarantee and a Uniform Commercial Code (UCC) lien might be required, you don’t need to pledge specific assets to qualify for an MCA.

Merchant cash advances offer a flexible, quick, and accessible financing solution for a variety of business needs, making them an excellent option for addressing immediate financial challenges and opportunities.

SECTION 3

How Much Does a Merchant Cash Advance Cost?

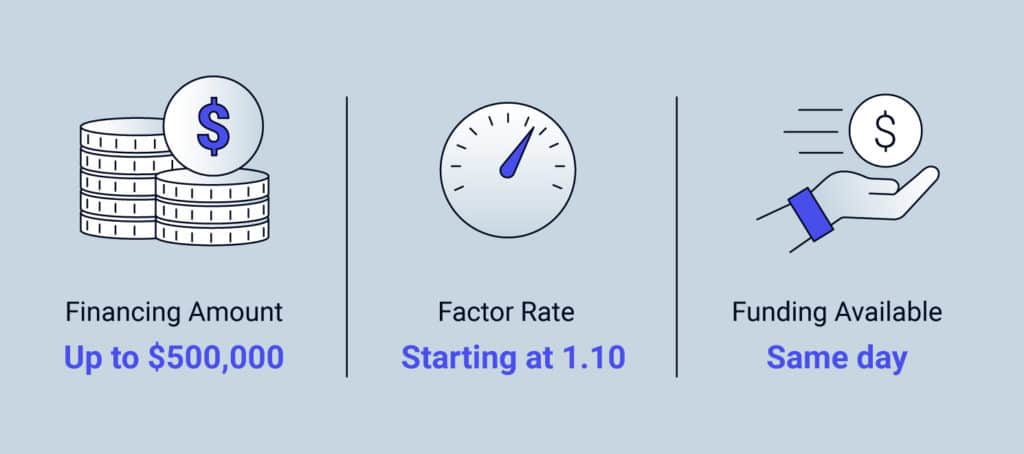

Repayment Obligations

When you secure a merchant cash advance (MCA), you typically agree to repay 10% to 30% or more of the total advance amount. This repayment percentage is known as a factor rate and is usually expressed as a decimal. For example, a factor rate of 10% is represented as 1.1, and a factor rate of 30% is shown as 1.3. At iBusinessLender, our merchant cash advance rates start at 1.10.

The exact repayment amount depends on several variables, including the amount of funding, the factor rate, and the repayment term. You can use our ACH merchant cash advance calculator to accurately estimate your financing payments.

Understanding Factor Rates

Unlike interest rates, which accrue over time and are calculated on a decreasing principal balance, factor rates are set at the origination of the advance and remain fixed. This means the cost is built into your scheduled payments from the start.

The factor rate you receive is influenced by various aspects of your business, such as:

- Your industry

- Average monthly sales

- Consistency of sales

- Length of time in business

- Other risk-related factors

Merchant Cash Advance Factor Rate Examples

To illustrate how factor rates impact your total repayment, consider the following examples using the formula:

Advance Amount×Factor Rate=Total Payback Amount\text{Advance Amount} \times \text{Factor Rate} = \text{Total Payback Amount}

Example Scenarios

- Advance Amount: $10,000

- Factor Rate: 1.25

- Total Payback: $12,500

- Advance Amount: $50,000

- Factor Rate: 1.15

- Total Payback: $57,500

- Advance Amount: $100,000

- Factor Rate: 1.10

- Total Payback: $110,000

These examples demonstrate how the factor rate determines the total amount you will repay over the term of the advance. By understanding these rates and using tools like our ACH merchant cash advance calculator, you can better manage your financing and make informed decisions for your business.

SECTION 4

Merchant Cash Advance Requirements

Lenient Merchant Cash Advance Requirements

Merchant cash advances (MCAs) are known for their flexible qualification criteria. According to the Federal Reserve Banks’ State of Small Business Credit Survey, a remarkable 84% of firms that applied for an MCA were approved.

What Our Lenders Evaluate

Unlike traditional loans that heavily weigh personal and business credit scores, MCA providers focus on the consistency of your historical deposits and average daily balances to predict future revenue and determine approval amounts.

Underwriting Criteria

- Industry: Different industries carry varying levels of risk for MCA providers. Sectors with volatile sales volumes may be considered higher risk, potentially leading to higher factor rates.

- Business Tenure: Typically, only a few months of operation are required to qualify. However, newer businesses might face higher factor rates.

- Business Sales and Growth: Lenders assess your financial history to evaluate your ability to repay the advance. Consistent sales and a history of growth can result in better rates and terms, as MCAs are repaid from future revenues.

- Business Credit History: While less crucial than in traditional loans, your business credit score still impacts MCA approval. Generally, a higher credit score can lead to a lower factor rate.

iBusinessLender Minimum Qualifications

At iBusinessLender, the qualifications for a merchant cash advance are straightforward and accessible. You are likely to qualify if you meet the following criteria:

- Business Tenure: At least 4 months in operation

- Annual Revenue: Minimum of $100,000

- Credit Score: 500 or better

By focusing on these key areas, iBusinessLender ensures that even businesses with shorter histories or lower credit scores can access the funding they need through a merchant cash advance.

SECTION 5

Merchant Cash Advance Through iBusinessLender

What Sets Us Apart

Numerous small businesses have entrusted us with their financing needs and it shows in our ratings.

How to Apply for a Merchant Cash Advance

Complete our straightforward and secure application to receive offers from our MCA lending partners.

Applying for a merchant cash advance is swift and hassle-free, with no impact on your credit.

- Save Time: Submit your online application in minutes. Upon approval, access your funds the same day.

- Find the Best Offer: When urgency is paramount, you don’t have time for extensive research. With iBusinessLender, one application grants you access to rates and terms from our nationwide network of lenders.

- Choose Your Financing: Evaluate your merchant cash advance terms and choose the optimal option for your business. Our expert advisors are available to assist you every step of the way.

SECTION 6

Merchant Cash Advance: Frequently Asked Questions

Our merchant cash advance (MCA) lending partners do not report to credit bureaus. As a result, the funding you receive does not appear as additional debt on your credit report.

Utilize MCA Funds to Improve Credit

This feature presents a unique opportunity to use MCA funds to pay off existing business debt. For example, if you have maxed out a business credit card and your credit score has taken a hit, you can use MCA financing to pay down that debt and potentially improve your credit score.

By leveraging MCA funds to manage your existing debt, you can reduce your credit utilization ratio and positively impact your credit profile, all without adding to your reported debt load.

Business owners should consistently evaluate their cash flow and make decisions based on their immediate financial needs. It’s important to use merchant cash advance (MCA) financing responsibly and avoid overextending your financial resources. For instance, if you qualify for $50,000 but only need $25,000, it is wiser to borrow the smaller amount.

Practical Tips for MCA Usage

- Borrow What You Need: Only take out the amount necessary for your current requirements. This helps in managing repayments and ensures you are not burdened with unnecessary debt.

- Purpose-Driven Funding: Avoid obtaining an MCA just to have extra funds sitting idle in your bank account. Each dollar borrowed should have a clear and productive purpose to support your business’s growth or operational needs.

By following these guidelines, you can make the most of merchant cash advances while maintaining healthy financial practices for your business.

Because merchant cash advances (MCAs) have less stringent qualification requirements, financing providers assume a higher level of risk. To offset this risk, they offer shorter repayment terms than other financing options and require more frequent payments. This approach ensures that repayments are made promptly, thereby reducing the potential for losses for the providers.

Merchant cash advances (MCAs) offer flexibility with no restrictions on how the funds can be utilized. However, they are particularly suited for addressing short-term business capital needs.

Common Uses for MCAs

- Purchasing Inventory: Quickly restock products to meet customer demand.

- Buying Equipment: Acquire essential machinery or technology to enhance operations.

- Bridging Cash-Flow Gaps: Smooth out periods of uneven cash flow to maintain business continuity.

- Covering Operating Expenses: Manage everyday expenses such as rent, utilities, and payroll.

- Acting on Investment Opportunities: Seize timely opportunities that can drive growth.

- Paying for Emergency Expenses: Handle unexpected costs without disrupting your business.

Both term loans and merchant cash advances (MCAs) provide business owners with a lump sum of capital upon approval. However, MCAs are specifically designed for short-term funding needs. Repayment terms for MCAs typically start at a few months and can extend up to 18 or 24 months in some cases. Payments are usually made daily and are based on a factor rate instead of an interest rate. With ACH MCAs, installments are fixed for the duration of the term and are automatically withdrawn from a linked bank account.

Term Loans

In contrast, term loans generally have longer repayment periods. At iBusinessLender, our lending partners offer term loans with durations ranging from 1 to 5 years. Payments are typically made weekly or monthly rather than daily. Additionally, term loans often prove to be more cost-effective compared to merchant cash advances, featuring lower interest rates than the factor rates associated with MCAs.

By understanding these differences, business owners can choose the financing option that best suits their specific needs and financial situation.