A Quick Capital Solution

If you find yourself in a sudden cash crunch or face an exciting opportunity that requires immediate action, a short-term business loan might be the perfect solution. These loans offer rapid funding with minimal obstacles, allowing you to act swiftly and capitalize on opportunities as they arise. The advantage? You can repay the loan quickly, avoiding prolonged financial obligations.

At iBusinessLender, we work with a variety of lenders who specialize in short-term business loans and other adaptable financing options to meet your urgent capital needs. This collaboration ensures that you have access to the resources necessary to address immediate financial demands efficiently and effectively.

Contents

SECTION 1

Understanding Short-Term Business Loans

A short-term business loan grants approved borrowers a lump sum of money, which is to be repaid over a brief period. This funding can be used for a range of business activities, including renovations, buying inventory, covering operational costs, or preparing for busy seasons.

How Does a Short-Term Business Loan Work?

A short-term small business loan provides borrowers with quick access to working capital, which is repaid in daily, weekly, or monthly installments based on the terms set by the lender. Through regular payments, borrowers incrementally pay down the principal and interest, completing repayment within a short timeframe, usually between 3 to 18 months. This type of financing is designed to support businesses in managing immediate financial needs or taking advantage of time-sensitive opportunities without the long-term commitment of traditional loans.

SECTION 2

When Is a Short-Term Business Loan the Right Choice?

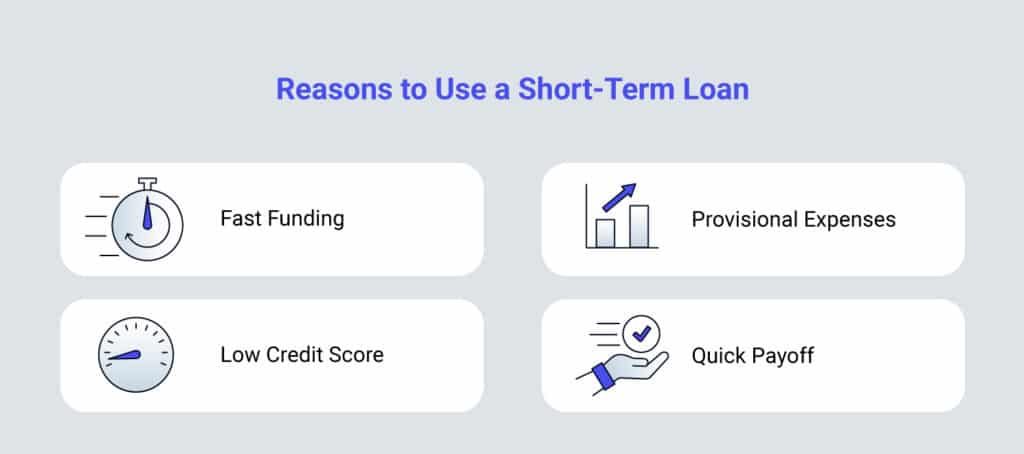

A short-term loan could be a smart choice if your business needs an immediate influx of capital and you are sure you can fully repay the debt promptly. Here are several reasons to consider opting for this type of financing:

Fast Funding

A short-term small business loan can be the quickest route to funding, with approval possible within hours and funds potentially arriving in your account the same day. This is a stark contrast to traditional business loans from conventional lenders, which can take weeks or even months to process.

Provisional Expenses

Short-term business loans are excellently suited for managing temporary capital needs. They are not designed for covering high-cost, long-term projects that might take years to generate a return on investment. Rather, they are ideal for periods when your business experiences fluctuating cash flows, is in the midst of expansion, or needs to capitalize on immediate opportunities.

Low Credit Score Requirements

Short-term loans from providers like iBusinessLender, which do not require collateral, offer an easier route to funding compared to secured bank loans. These typically demand collateral, high credit scores, and significant revenue. Short-term loans come with more accessible eligibility criteria, making it possible for your business to secure necessary funds for growth. A minimum annual revenue of $75,000, a credit score of at least 540, and a business history of one year are often enough to qualify.

Quick Payoff

Short-term business financing generally involves smaller amounts of money and shorter repayment terms. It’s common for these loans to have very brief payoff periods, sometimes as short as three months, allowing your business to quickly free itself from debt. This rapid repayment schedule can be beneficial for businesses looking to manage debt efficiently and avoid prolonged financial commitments.

SECTION 3

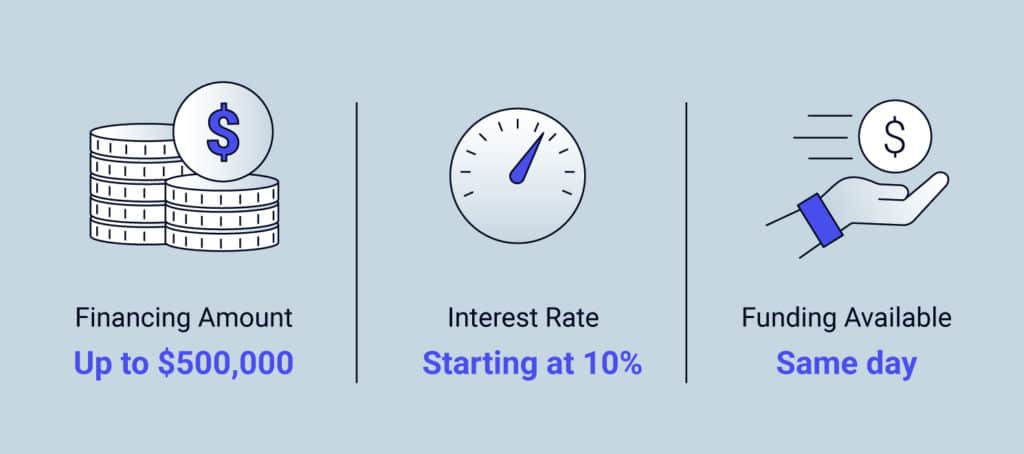

What Does a Short-Term Business Loan Cost?

The cost of a short-term business loan can fluctuate depending on several key factors, including your credit score. At iBusinessLender, the interest rates for our short-term business loans start at 10%. Generally, short-term loans carry higher interest rates compared to longer-term options because they pose a greater risk to the lender due to the rapid repayment schedule.

Short-Term Loan Example

Consider a scenario where you need a short-term loan to buy inventory and hire additional staff for the upcoming peak season. Suppose a lender approves a $10,000 short-term loan for your business at an interest rate of 10%, with a repayment term of 12 months. If you opt for monthly installments, you would pay around $879 each month. Alternatively, if you choose a weekly repayment plan, your payments would be approximately $204 per week, spread over 52 weeks.

This example illustrates the flexibility in repayment options available for short-term loans, allowing you to align the loan repayments with your business’s cash flow and operational needs. Such loans are particularly useful for addressing immediate business requirements without long-term financial commitments.

SECTION 4

How to Qualify for a Short-Term Business Loan

Securing a short-term business loan is generally quicker and more straightforward than obtaining a traditional term loan. The longer your business has been operational and the stronger your credit history and score, the more favorable the terms you can expect.

What Our Lenders Evaluate

Our short-term business lending partners improve approval rates by thoroughly evaluating various aspects of your business to mitigate their risk. While your credit rating is certainly considered, your business’s cash flow and revenue are also pivotal. This holistic approach acknowledges that a strong and consistent cash flow can compensate for other potential challenges that might prevent a business from obtaining financing.

iBusinessLender Minimum Qualifications

If you’re in the market for a short-term business loan and are concerned about your credit, iBusinessLender collaborates with lending providers that accommodate credit scores starting at 540. This makes it possible for businesses with less-than-perfect credit to still access the funding they need.

Other essential qualifications for a short-term business loan include:

- Being operational for one year or more

- Generating at least $75,000 in annual revenue

These criteria ensure that even businesses facing financial challenges have access to the capital they require for growth and operational needs.

SECTION 5

Short-Term Business Loans Through iBusinessLender

What Sets Us Apart

Many small businesses have trusted us with their financing needs, including our short-term business funding products, and it shows in our ratings.

How to Apply for a Short-Term Business Loan

iBusinessLender makes it easy to access top short-term business lending options through a unified, efficient application process.

Applying for a short-term business loan online is designed to be fast and straightforward — importantly, you can get preapproved without any impact on your credit score.

Application Process in Three Easy Steps:

- Submit Your Details: Fill in essential information about yourself and your business to help lenders assess your application.

- Upload Financial Documents: Provide recent bank statements that demonstrate your business’s financial health.

- Review Loan Offers: You’ll receive multiple loan proposals, allowing you to compare and choose the best one that fits your business needs.

Once you’ve chosen the most suitable offer, your short-term business loan can be processed and the funds released as quickly as within one business day following approval. This swift funding process helps you meet urgent business demands efficiently.

SECTION 6

Short-Term Business Loans: Frequently Asked Questions

The short-term business financing offered through an iBusinessLender lending partner is versatile, with no restrictions on how you can use the funds. Nevertheless, due to its rapid repayment schedule, it is not ideal for long-term projects that require extended financing.

Common applications for short-term business loans include:

- Inventory Purchases: Ideal for buying stock quickly, especially in preparation for peak sales periods.

- Emergency Expenses: Useful for unexpected costs that need immediate attention to keep your business running smoothly.

- Cash-flow Shortages: Helps bridge gaps in cash flow, ensuring that operations continue without disruption.

- Upfront Project Costs: Provides the necessary capital to kick-start new projects or expansions before other revenue sources can be secured.

These loans are designed to be flexible and fast, addressing immediate financial needs that your business may encounter.

Pros

One of the main advantages of short-term business funding is its flexibility in how the funds can be used. This type of financing usually features a fast and simple application process that requires minimal paperwork. Additionally, the qualification criteria are generally more lenient compared to other types of loans. In some cases, funds can be disbursed as quickly as within one day after approval, making it a highly responsive financial solution.

Moreover, consistently repaying a short-term business loan on time can improve your credit profile, especially if the lender reports to credit bureaus. This can be beneficial for future credit applications.

Cons

Despite these advantages, there are some downsides to consider with short-term business loans. Typically, the interest rates for these loans are higher than those for long-term loans. Many short-term financing options also require frequent repayments—either weekly or daily—which can strain your cash flow if your business does not generate consistent income.

Furthermore, due to the short repayment timeframe, lenders often offer smaller loan amounts. This can limit the scope of projects or needs that can be financed through short-term loans, making them less suitable for more significant, long-term investments.

A short-term business loan is fundamentally a term loan with a brief repayment timeline. However, this term is also commonly applied to a range of other financing solutions that feature short repayment terms, such as business lines of credit, merchant cash advances, and invoice financing. Each of these financial products differs in structure and function from a traditional short-term business loan:

- Term Loan: This is a one-time lump-sum loan that typically has a specified repayment period that is generally longer than the repayment term for a short-term loan.

- Business Line of Credit: This is a flexible financing option where small business owners have access to a specified amount of funds, which they can draw from as needed up to a pre-approved limit. The available credit replenishes as the borrowed amounts are repaid, making it a revolving form of credit.

- Merchant Cash Advance: This is an advance of capital that is given based on the business’s projected future sales. It’s typically repaid via a percentage of daily or weekly sales, aligning the repayment schedule closely with the company’s cash flow.

- Invoice Financing: This type of financing provides a cash advance against the amounts due from outstanding invoices. Businesses can access immediate cash flow by leveraging the value of their receivables.

Each of these alternatives has unique characteristics and may be suitable for different types of financial needs, offering various flexibility and repayment structures compared to traditional short-term business loans.